The COVID-19 crisis has accentuated long-term trends in the European equity market, with Health Care solidifying its dominance in the STOXX® Europe 600 Index, and Banks shedding further ground.

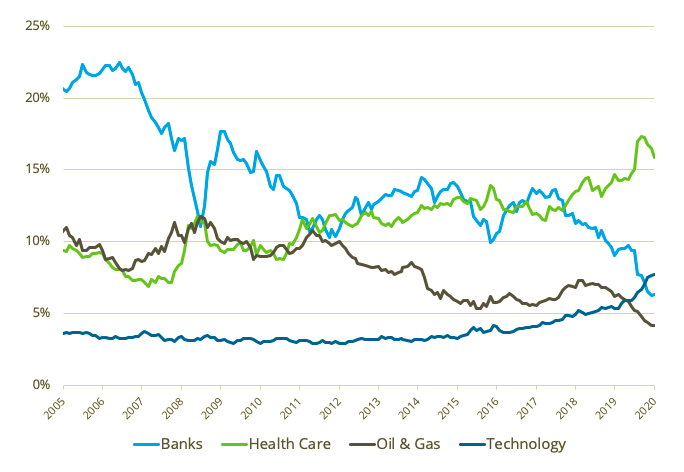

Banks represented over 20% of the European benchmark before the global financial crisis, but have been trending down ever since, dipping to a 15-year low of 6% by August-end. In contrast, Health Care’s weight in the index has risen gradually over the past 15 years, becoming the largest of 19 Supersectors in 2018 — a position it has strengthened this year (Exhibit 1).

Exhibit 1 – STOXX Europe 600 Index Supersector weights since 2005

Source: Qontigo.

Technology trumps Banks and Oil & Gas for first time in 15 years

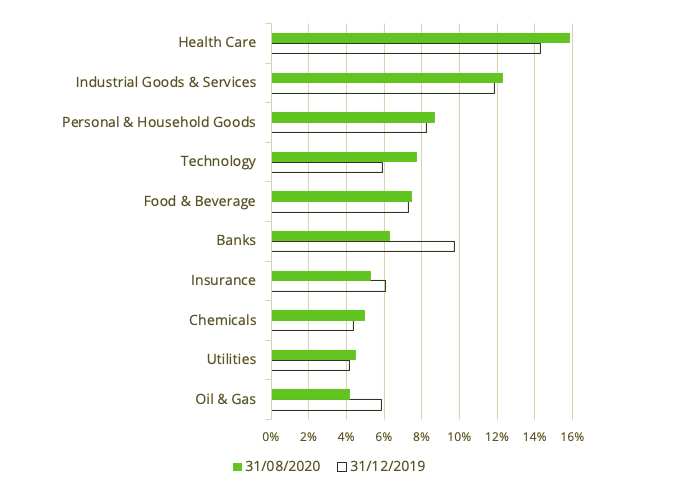

Banks and Oil & Gas have been the worst performers in Europe so far this year, while Technology and Health Care have been among the best ones. All four recorded the largest changes ever in their index weights in 2020 through August (Exhibit 2).

The crisis has put even more stress on European banks, which were already struggling with negative interest rates, slow economic growth in Europe, tighter capital rules and Brexit. Banks went from ranking third at the beginning of the year to sixth at the end of August.

Not surprisingly, the pandemic has ensured that Health Care remained the largest Supersector in the STOXX Europe 600 Index (its weight neared 16% in August), followed by Industrial Goods & Services and Personal & Household Goods.

Technology moved up three places to the fourth slot in 2020 and — for the first time in 15 years — its weight (8%) exceeded that of both Banks and Oil & Gas.

Exhibit 2 – STOXX Europe 600 Index Top 10 Supersector Weights: Dec. 2019 vs. Aug. 2020

Source: Qontigo.

The September rebalance will not have a major impact on any Supersector

The upcoming rebalance of the STOXX Europe 600 on Sep. 21 may have some impact on individual names but is likely to have only a small effect on each Supersector’s weight.

On Sep. 1, Qontigo announced that 15 stocks will be added and 15 deleted from the STOXX Europe 600 benchmark, effective Sep. 21. The changes will affect 11 out of the 19 Supersectors, but there will be no significant modifications in their weights in the index. Most names added and deleted belong to the 10 largest Supersectors. The rankings of Supersector weights in the European benchmark will most likely be unchanged after this rebalance.

Two lenders’ stocks will exit the blue-chip benchmark EURO STOXX 50® Index on Sep. 21, but the broader STOXX Europe 600 will not see any banks leave. The decline in Banks’ weight in both indices began over a decade ago, resulting not from a discrete index rebalance, but rather a much broader trend in the European market that started during the European debt crisis. For more insights on the changes in Supersector weights in various STOXX benchmarks, please see our recent blog post entitled ‘A Decade of Changing Sector Exposure for European Equities.’

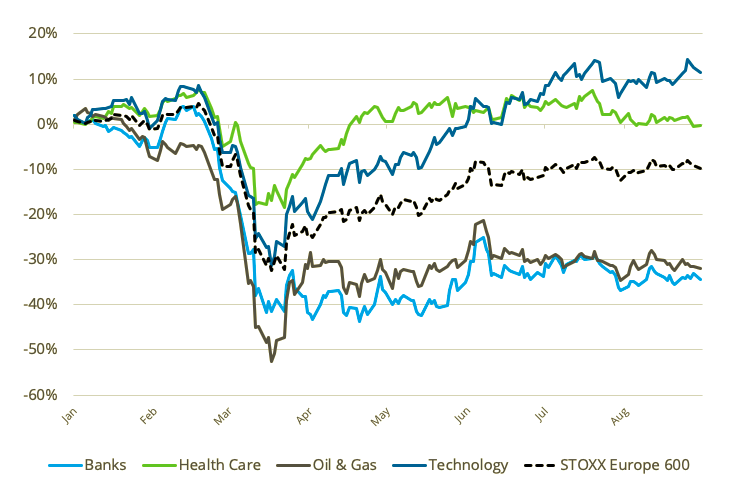

Banks — worst performers

Only three Supersectors in the STOXX Europe 600 have recovered from the market downturn earlier in the year and posted positive year-to-date cumulative returns as of Aug. 31. Technology is one, and with an 11% advance it shows the largest year-to-date gain, followed by Chemicals and Utilities.

Banks have been unable to recover from the extreme losses suffered in March. Through August, they recorded the largest year-to-date loss among all groups, at a 34% decline. More than 80% of banks in the Supersector recorded losses. Moreover, four companies were responsible for half of the entire group’s year-to-date aggregate loss. Oil & Gas followed closely with a 32% retreat (Exhibit 3).

Surprisingly, although Health Care rebounded, its cumulative return is flat for the year.

Exhibit 3 – 2020 performance through August

Source: Axioma. Daily cumulative returns on STOXX Europe 600 Supersector indices.

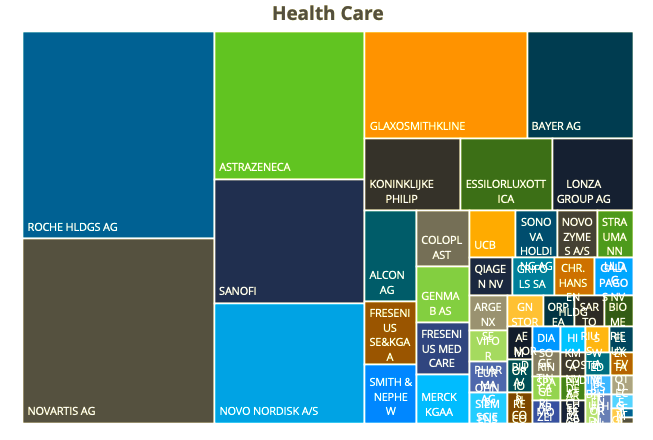

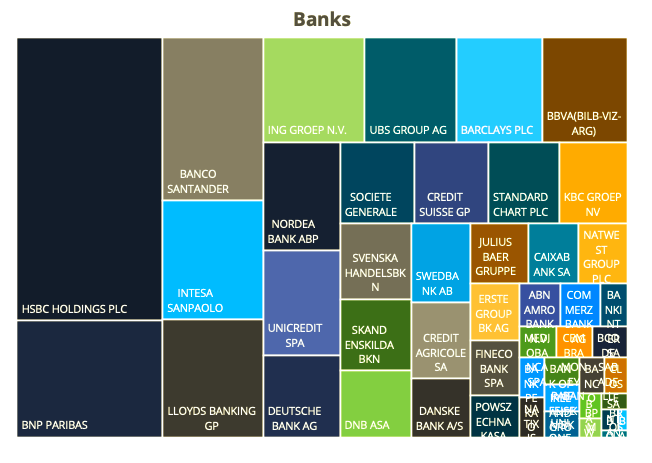

The STOXX® Europe 600 Banks Index and STOXX® Europe 600 Health Care Index have been extremely concentrated in 2020, with the top 10 stocks representing 60% and 76% of each Supersector, respectively (Exhibit 4). Roche, Novartis, AstraZeneca and Sanofi made up more than 50% of Health Care and, despite the health crisis, not all contributed positively to their Supersector’s return.

HSBC, BNP Paribas, Banco Santander and Intesa Sanpaolo were responsible for half of Banks’ negative year-to-date return. Interestingly, only eight out of 47 banks in the Supersector have posted gains in 2020.

Exhibit 4 – Stock average weights in 2020

Source: Qontigo.

Health Care, second-least volatile Supersector

Risk has come down from the peaks seen during the market collapse in February-March, but it remains twice to three times higher than at the beginning of the year for all Supersectors.

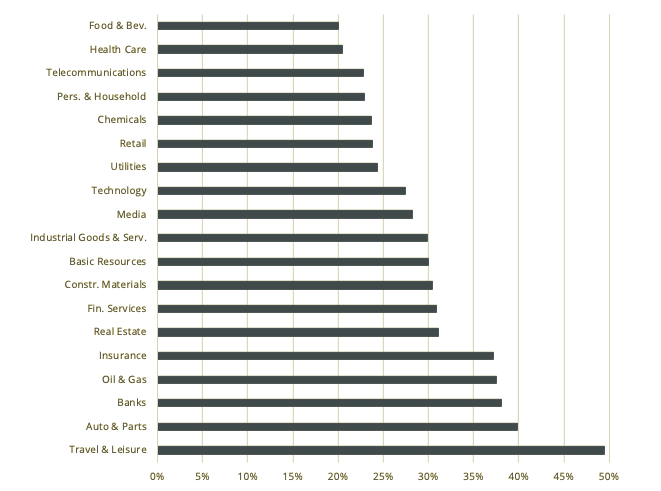

Health Care not only was the largest sector in the European index on Aug. 31, but also one of the least risky. Only Food & Beverage recorded a lower level of predicted risk, as measured by Axioma’s US Medium-Horizon Fundamental Model. Banks and Oil & Gas were among the riskiest, surpassed only by Automobiles & Parts and Travel & Leisure. Technology’s risk was in the middle of the pack (Exhibit 5).

Exhibit 5 – Predicted total risk

Source: Qontigo. Supersector forecast risk as of Aug. 31, 2020, based on Axioma’s US Medium-Horizon Fundamental Model and STOXX Europe 600 Supersector indices.

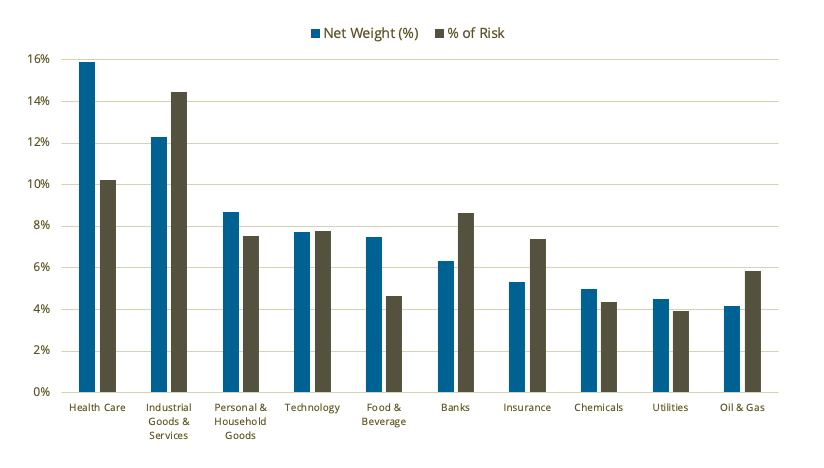

Despite its dominance in the STOXX Europe 600, Health Care was only the second contributor to benchmark risk, after Industrial Goods & Services. Health Care’s contribution was six percentage points lower than its weight would otherwise suggest, as measured by Axioma’s US Medium-Horizon Fundamental Model (Exhibit 6). The opposite was true for Banks and Oil & Gas, whose contributions exceeded their weights in the index.

Exhibit 6 – STOXX Europe 600: Top 10 Weights and % of Risk

Source: Axioma’s US Medium-Horizon Fundamental Model.

Conclusion

As discussed, the COVID-19 crisis has accelerated the long-term trends in the European market. Investors using the STOXX Europe 600 as their benchmark will need to realign their portfolios to this new reality, with Health Care in the spotlight, Banks relegated to sixth place in the index, and Technology stocks gaining ground.

1 STOXX indices use the ICB classification.