The STOXX® Global ESG Leaders Index was launched in 2011 and was an important step for providing visibility for companies that excel in sustainable operations and management. The index is STOXX’s broadest benchmark tracking the highest-scoring companies in environmental, social and governance (ESG) criteria, and is based on indicators researched by Sustainalytics.

To coincide with the ninth annual review of the index, which became effective on Sep. 21, a new Qontigo whitepaper1 looks into the methodology behind the index, explores how its composition has changed over time and assesses the impact of the latest changes.

Key points in the analysis include:

- The Global ESG Leaders Index represents nearly a quarter of the benchmark STOXX® Global 1800 Index by weight

- The ESG index has consistently had a higher average ESG score than that of the benchmark

- Over the years, Industrials and Utilities have increased their representation in the ESG Leaders index, at the expense of sectors such as Consumer Discretionary and Consumer Staples

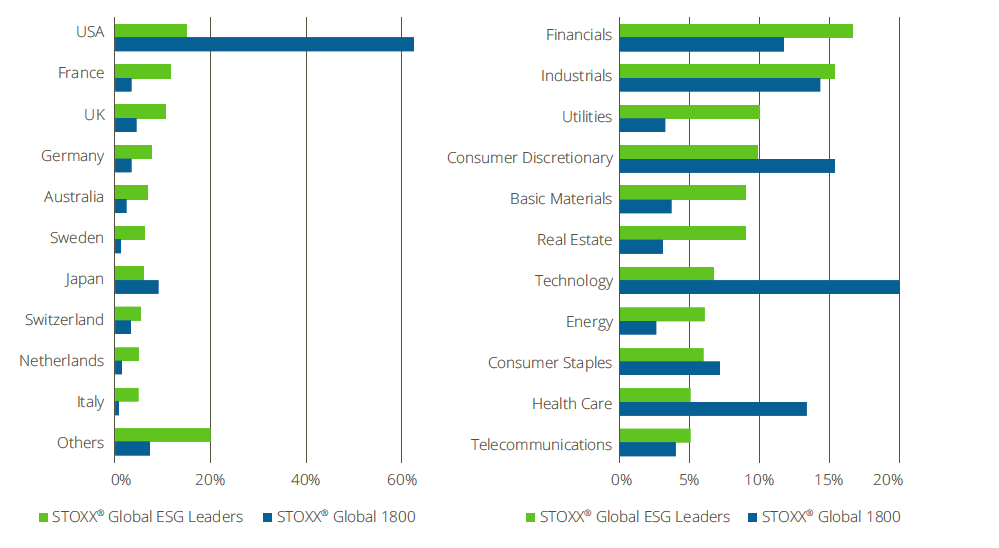

- The ESG Leaders index has historically had a balanced country representation compared to the benchmark, although the top three countries — US, France and UK — collectively account for more than a third of its weight

How the index changed this week

The authors then turn to the composition of the ESG Leaders index following the latest annual review, announced this month. A total of 73 companies entered the index on Sep. 21, including the highest number of US-based entrants in at least seven years.

Exhibit 1, from the report, shows that the ESG Leaders index has a significant underweight to the US, allocating more of that capital across other large countries. In industries, the ESG Leaders index has lower exposure to Technology, Health Care and Consumer Discretionary than does the benchmark, in favour of Utilities, Basic Materials and Real Estate.

Exhibit 1 – Country allocation (right) and industry allocation (left)

“The 2020 annual index review for the STOXX Global ESG Leaders Index has resulted in a slightly improved average ESG score for the index, with allocations to countries and sectors witnessing only marginal changes,” write Anand Venkataraman and Ladi Williams, of Qontigo’s Index Product Management team, in the report. “More than half of the index, both by number of constituents and in terms of weights, is represented by constituents that have been members for three years or more, providing stability to the constitution of the index.”

We invite you to read the entire the whitepaper here and find out more about the STOXX Global ESG Leaders Index.

Featured indices

STOXX® Global ESG Leaders Index

1 Venkataraman, A., Williams, L., ‘STOXX Global ESG Leaders 2020 Annual Index Review Analysis’, Qontigo, September 2020.