As we reviewed the outlook for equity markets in 2018 in a recent article, UBS highlighted the disruptive trends of digitalization and robotics in its forecast, pointing out that technology stocks may continue their march higher.

UBS calls digital data ‘the new oil’ due to its growing value. The Swiss financial-services provider favors automation companies because of the exponential growth in ‘internet of things’ devices, as well as what has been referred to as the ‘fourth industrial revolution’ of intelligent automotive machines.

Such ‘themes’ helped thematic investing garner much attention in 2017. The year was characterized by a flurry of listings of passive vehicles tracking topics that are disrupting the modern economy, and money flows into these products suggest investors appreciated the choice.

From robots to innovative healthcare

The iShares Automation & Robotics UCITS ETF, which tracks one of four iSTOXX® FactSet Thematic indices, was Europe’s top smart-beta ETF by new assets in the first 11 months of 2017, according to ETFGI. While the fund’s share price had a total return of 47% in 2017,1 its net assets surged 17-fold through November.

The iSTOXX® FactSet Digitalisation index, also from the iSTOXX FactSet Thematic index family, advanced 27%.

Wrapping up STOXX’s thematic suite, the iSTOXX® FactSet Ageing Population index gained 22% in 2017 and the iSTOXX® FactSet Breakthrough Healthcare index rose 35%.

In a recent article on PULSE ONLINE, Roberto Lazzarotto, Global Head of Sales at STOXX, explained that thematic investors are challenging the norm with longer time horizons, placing bets on trends that far outpace the annual or even quarterly earnings calendar that has come to dominate equity markets.

This means large institutions with multi-year horizons, such as pension funds, may continue to add money behind these popular vehicles.

Continued demand for infrastructure investments

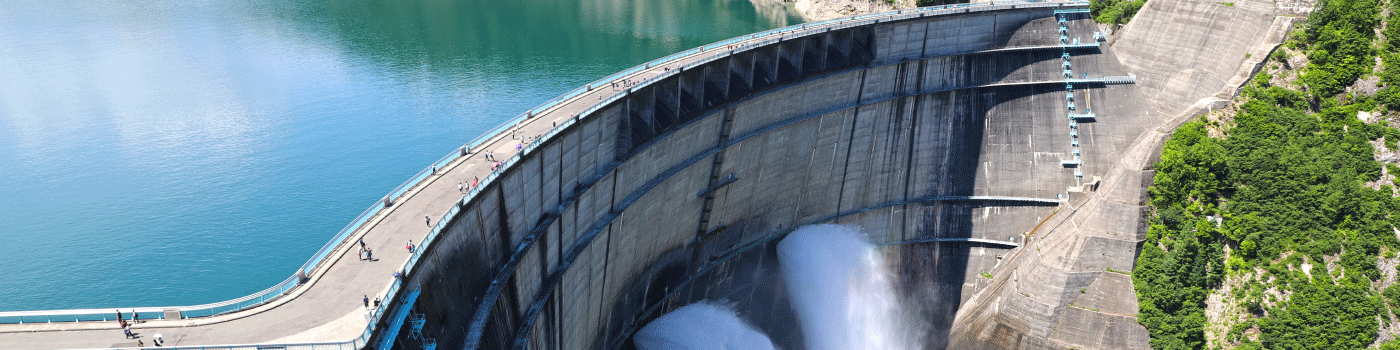

Another sector that investors are increasingly accessing via passive investments is infrastructure, a theme in its own right that ties in with long-term trends such as urbanization and water scarcity.

Infrastructure is poised to make headlines in early 2018 as US President Donald Trump works to unveil a long-awaited $1 trillion spending plan on everything from roads to bridges.

According to a recent IPE Real Assets survey, 2018 could see more institutional capital pumped into infrastructure.2 The sector is attracting investor interest as more national governments open up to private funding of projects, with the potential for attractive yields and protected cash flows.

“The low business risk and high dividends of infrastructure is hugely attractive for investors,” says Rod Jones, Head of North America at STOXX Ltd. “What is key is to have a broad definition of the sector, which allows investments in a varied and diversified portfolio of assets.”

The STOXX® Global Broad Infrastructure Index rose 16% in 2017.

STOXX’s thematic and infrastructure indices are compiled in partnership with FactSet, whose Revere industry hierarchy is the world’s most comprehensive business classification. Revere’s detail analysis of each company’s business and market allows STOXX to screen with accurate visibility for those companies best positioned to benefit from each theme and trend.

In our next article we’ll review the outlook for sustainable investing strategies.

Featured indices

- iSTOXX® FactSet Automation & Robotics

- iSTOXX® FactSet Digitalisation

- iSTOXX® FactSet Ageing Population

- iSTOXX® FactSet Breakthrough Healthcare

- STOXX® Global Broad Infrastructure

1 Net returns in USD.

2 IPE, ‘Infrastructure 2018 outlook: Investment volumes to rise?’ Dec. 22, 2017