The STOXX® Europe 600 Industry Neutral Ax Multi-Factor index provides investors with a broadly diversified portfolio designed to maximize exposure to several well-known style factors while minimizing exposures to industries and other style factors that may add to a portfolio’s risk but are not typically compensated. The expectation — and beauty of this approach — is that all style factors the index tilts on produce excess returns over time, but they do not all work at the same time. In other words, the use of multiple factors provides a significant diversification benefit and should weather all different kinds of markets.

The purpose of this article is to analyze the performance — and showcase the benefits — of a multi-factor strategy through time. Before we dive into the analysis, let’s briefly review the methodology and offering of the STOXX Industry Neutral Single and Multi-Factor indices.

STOXX Industry Neutral Factor Indices

The standard STOXX® Factor Indices are built using commercially accepted and institutionally tested factor definitions and Axioma’s advanced portfolio-construction tools and risk models. The indices target high exposures to proven sources of excess returns and, as well, manage liquidity and unintended risk exposures.

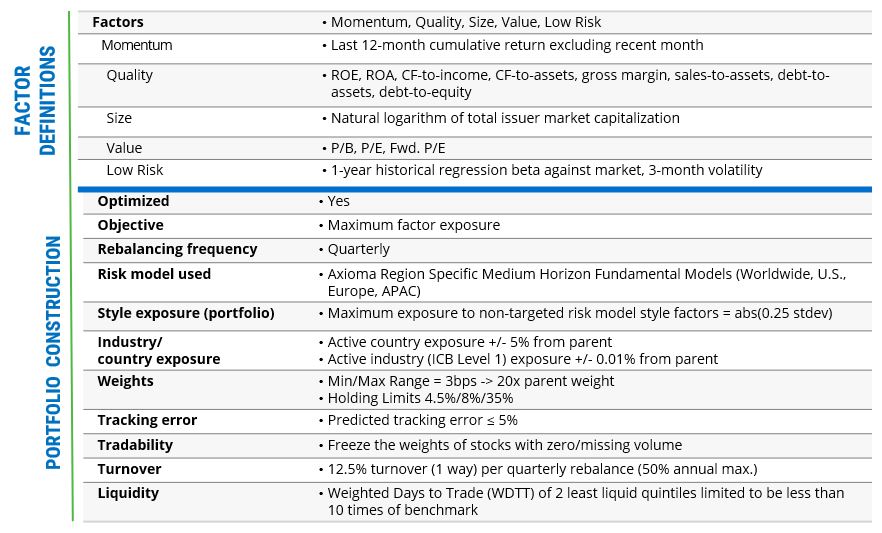

The STOXX® Industry Neutral Factor Indices (Table 1) implement the same methodology of the STOXX Factor Indices while reducing the active industry constraint from +/- 5% to near neutral. In all but eliminating the overall industry deviations, the STOXX Industry Neutral Factor Indices may sacrifice some factor exposure, but benefit from targeting lower levels of active industry risk and avoiding potential performance drag from industry returns.

As of today, Qontigo offers the STOXX Industry Neutral Factor Indices for the STOXX® Europe 600 and STOXX® USA 500 universes. All 12 indices underlie futures on Eurex.

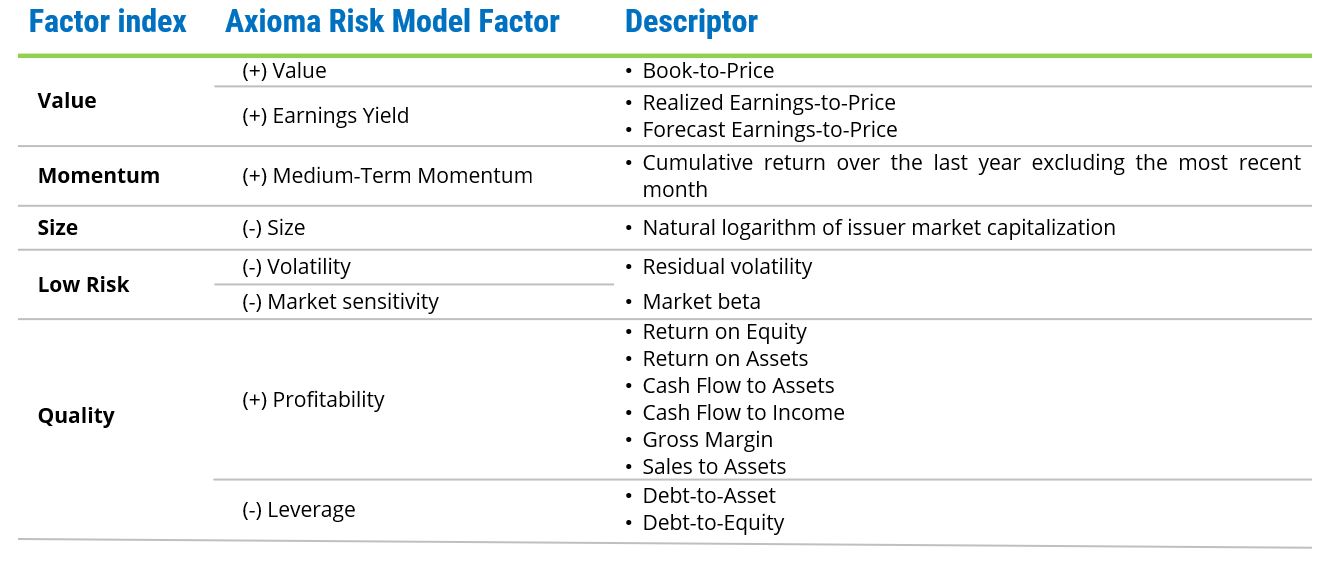

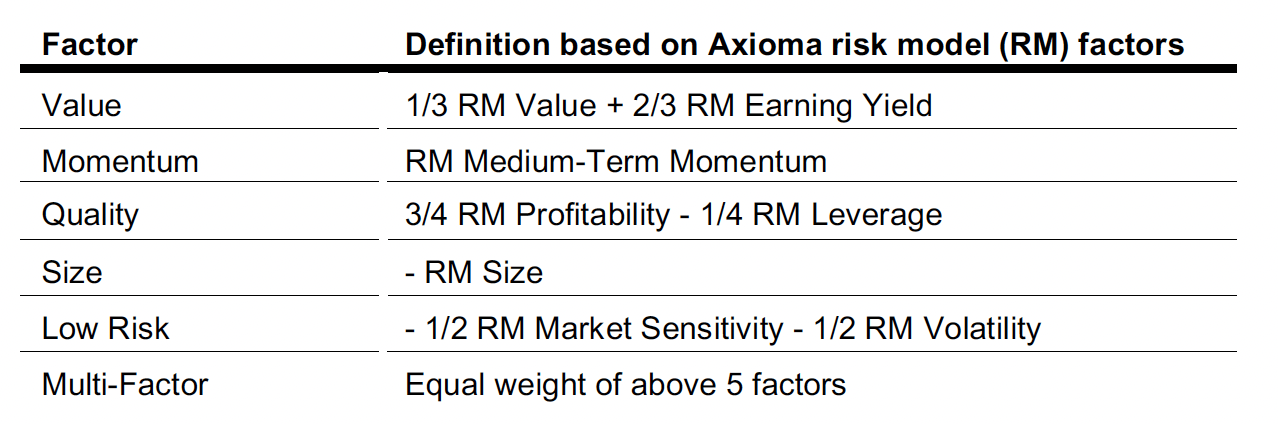

The five STOXX Industry Neutral Single Factor Indices target, in combination, the specific style factors of Value (using Axioma’s Earnings Yield and Value factors), Quality (with a positive tilt on Profitability and a negative tilt on Leverage), Low Risk (with a focus on low Market Sensitivity and low Volatility), Momentum (seeking high Medium-Term Momentum), and small Size (Table 2 — See Appendix 1 for more information). The STOXX Industry Neutral Ax Multi-Factor index combines all five single-factor indices on an equal-weight basis.

Table 1: STOXX Industry Neutral Factor indices

Table 2: Targeted risk model style factors in each STOXX Industry Neutral Factor index

Qontigo has made Factor iQ™ available to unpack and explore select STOXX indices’ exposure to factors. Factor iQ harnesses the power of Axioma’s daily risk models.

Multi-factor outperformance

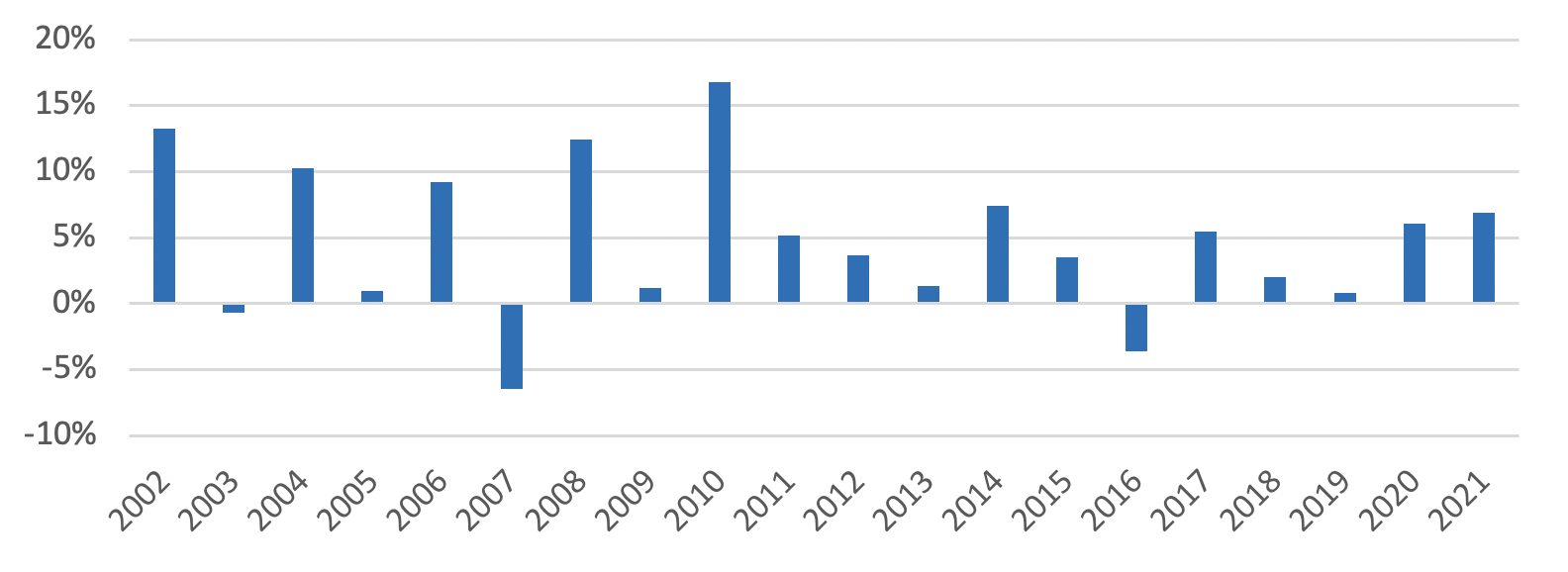

Turning back to the STOXX Europe 600 Industry Neutral Ax Multi-Factor index, it has indeed fared well (Exhibit 1). For the 20 years ended in 2021, it has outpaced its parent index and benchmark, the STOXX Europe 600, by more than 500 basis points annually, with a realized tracking error of just under 5%, thereby producing an information ratio of 1.06. The Multi-Factor index only underperformed in three of the past 20 years, and in one of those years — 2003 — the underperformance was slight in a strongly up market.

Exhibit 1: Annual active return for STOXX Europe 600 Industry Neutral Ax Multi-Factor Index

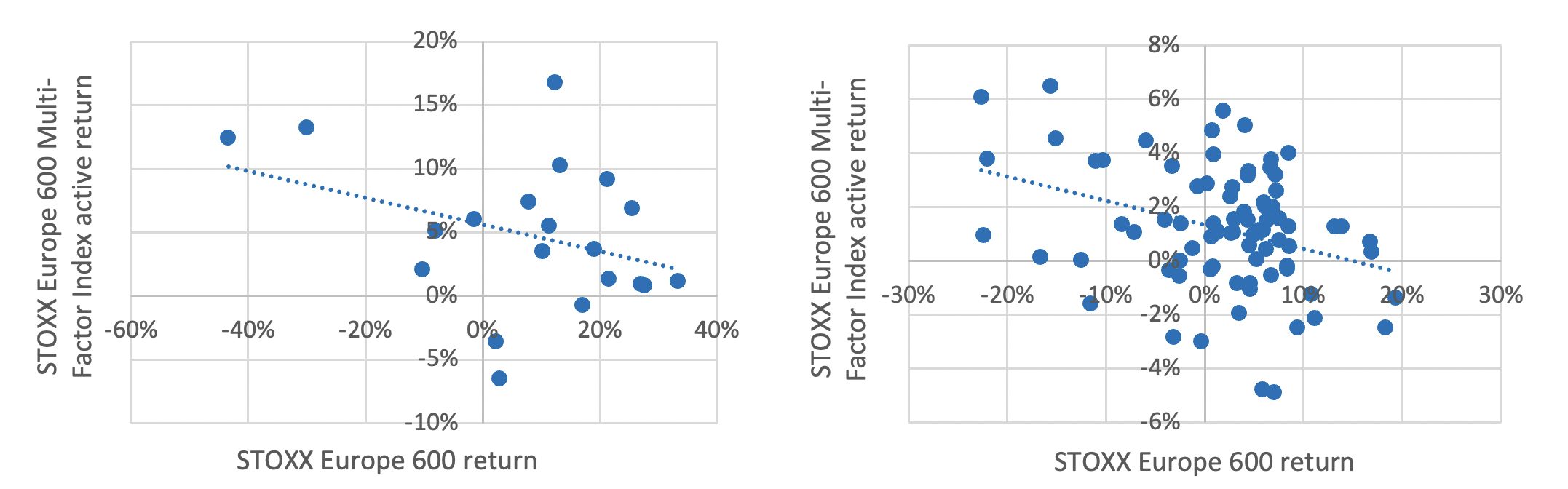

In general, active returns tended to be higher in years and quarters when the market was down (Exhibit 2). This makes sense, as (not to generalize too much), when markets are extremely strong, they tend to be characterized by more speculation, whereas the factors used in the Multi-Factor index depend on more rational types of investing (e.g., all things being equal, investors should prefer cheaper stocks, since they are getting more for what they are paying). This relationship is not perfect, however, and it is also important to note that the active return was positive far more often than it was negative, both on a quarterly and an annual basis.

Exhibit 2: Scatterplot of active vs. market returns, annual (left) and quarterly (right)

Returns attribution

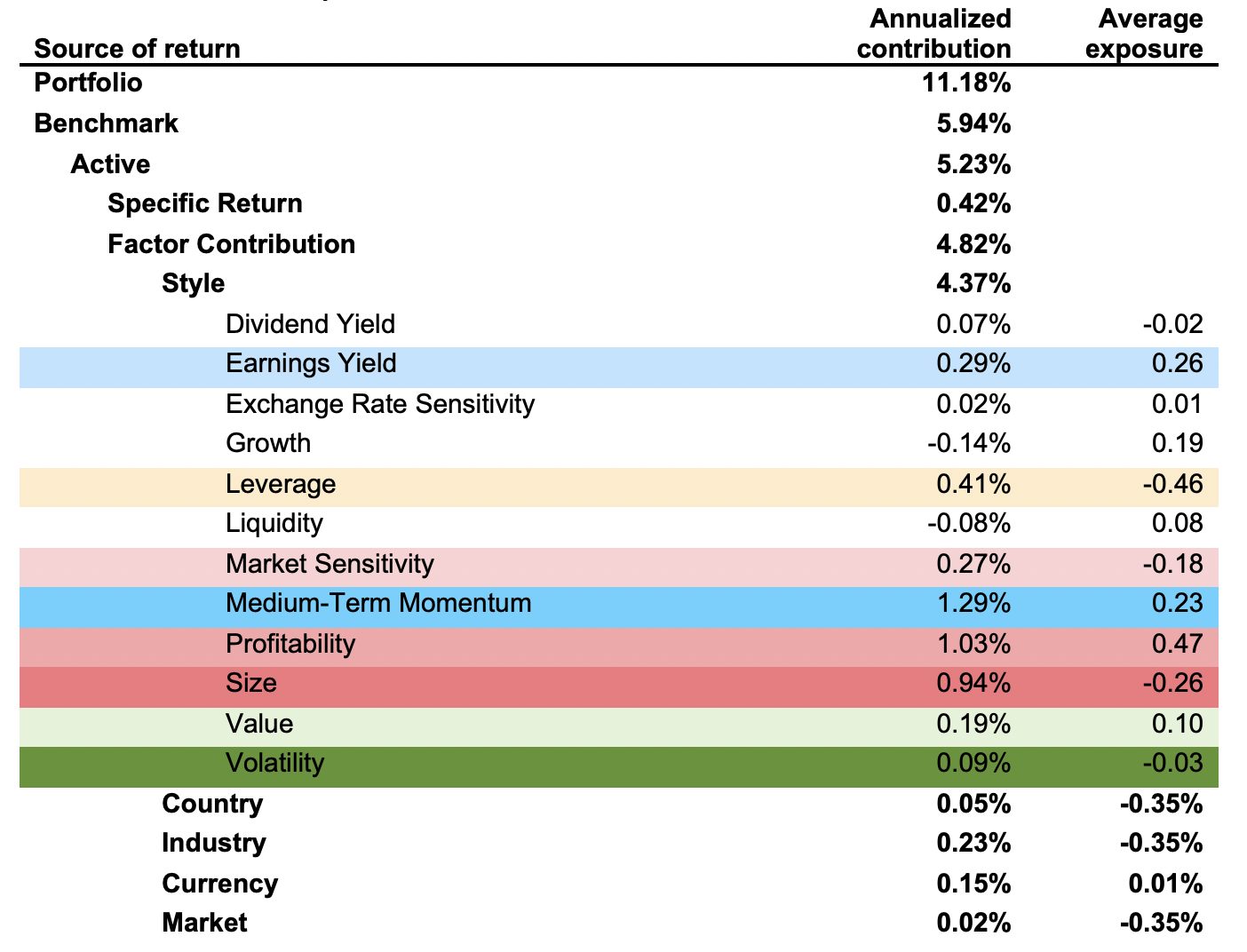

Attribution can tell us if the index’s active returns largely come from its factor exposures, and indeed we see that that is the case. Using the Axioma Portfolio Analytics tool, we decomposed the sources of active returns in the Multi-Factor index (Exhibit 3). We see that all of the underlying tilt factors contributed positively, albeit only slightly so in the case of Volatility (a style factor targeted by the Low Risk index).

Note that while industry exposures are kept very close to zero when the index is rebalanced, there may be some drift relative to the benchmark in between rebalancings, leading to some returns being attributed to those industry exposures. That proportion is typically quite small but was a positive contributor to return over time. Similarly, other investment style factors that were not emphasized in the portfolio construction process produced small contributions.

Exhibit 3: 2002–2021 performance attribution, STOXX Europe 600 Industry Neutral Ax Multi-Factor Index versus STOXX Europe 600

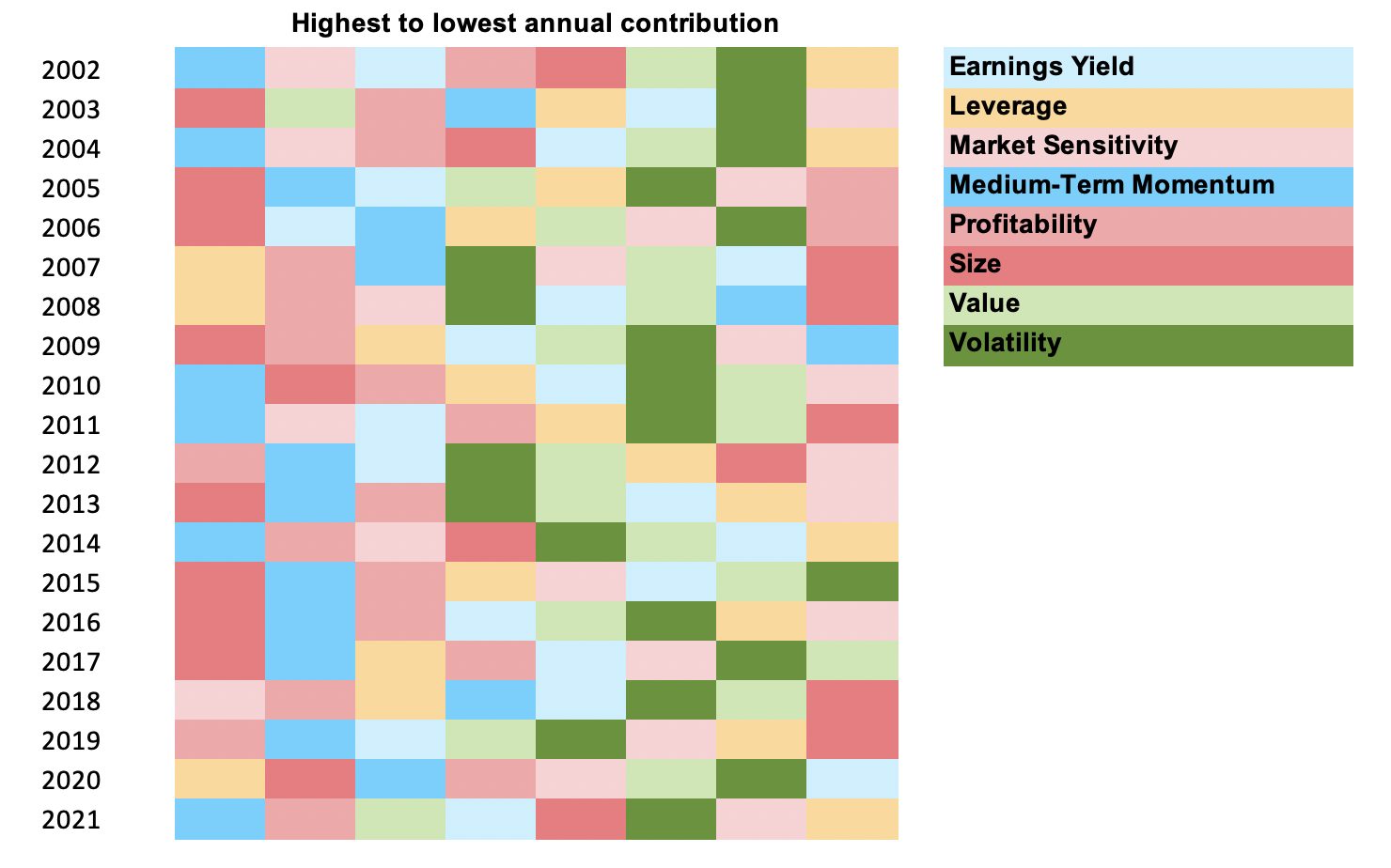

Exhibit 4 shows the year-by-year ranking of the tilted-on style contributions within the STOXX Europe 600 Industry Neutral Ax Multi-Factor Index and highlights the diversification benefits, as factors each took a turn to be one of the highest contributors, with the exception of low Volatility. Value was also — generally speaking — a poor contributor, making it into the top 3 list in only two of the years. In two other years, Value produced a substantial contribution, only overshadowed by very strong performances from a few other factors.

Exhibit 4: Heat map of targeted factor contributions, 2002 to 2021

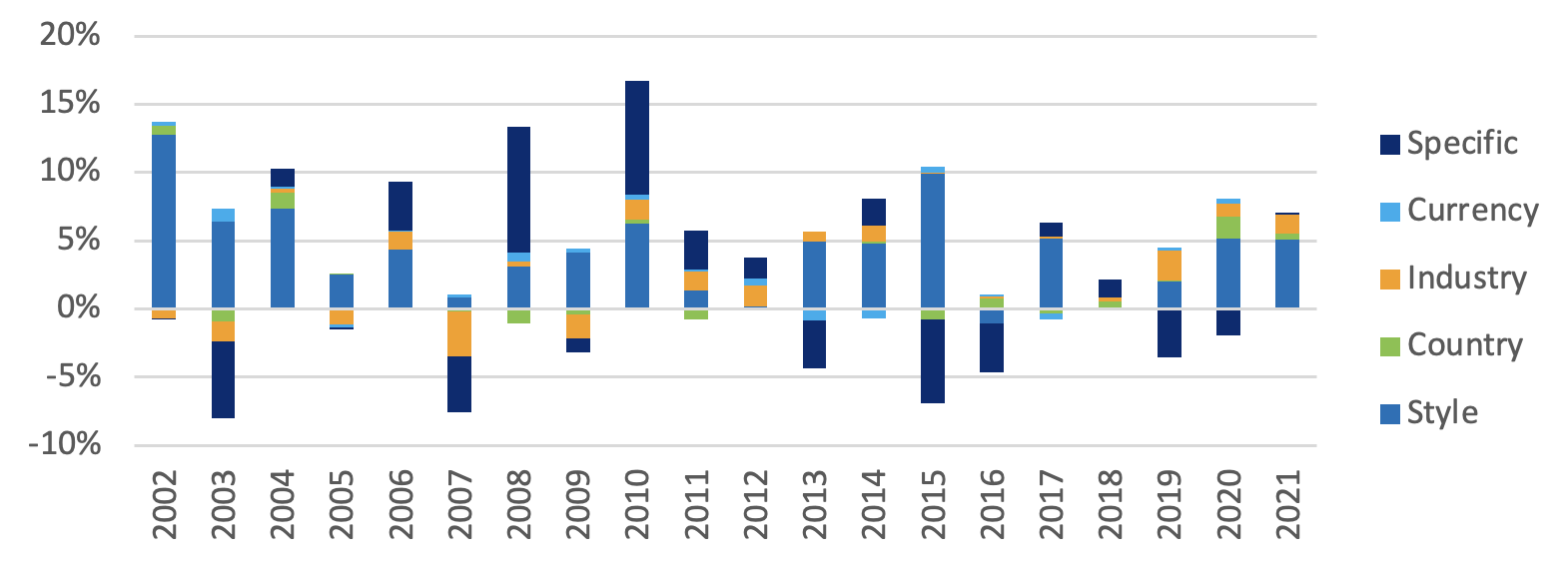

The STOXX Europe 600 Industry Neutral Ax Multi-Factor Index is constructed so that it gets most of its risk – and therefore return – from its style factor tilts, and we see that that is the case in most years. In a few years we see a large ‘specific return,’ or the proportion of actual return not explained by the factors (Exhibit 5). This large degree of specific return can often be traced to constraints. For example, the style factor returns assume that the investor can be long or short any name in a broad investment universe and that it rebalances daily. In real life, the index rebalances much less frequently, is limited to investing only in STOXX Europe 600 stocks, and can only be short up to the benchmark weight. Therefore, the return of the style factor may mis-state the achievable return for the index, and the difference will be allocated to the ‘stock specific’ return. So, if, say Value works better among small-cap stocks but the index can only buy larger names, it can’t achieve that return. See our papers “What Exactly is a Factor” and “What Is a Factor? Part 2: The Impact of the Long-Only Constraint” for more detail.

Attribution of annual returns by factor block shows that style factors contributed positively to returns almost every year. In some years that return was enhanced by ‘stock selection’ but in others it was offset by it. As noted, industry contributions were generally small, as were country and currency contributions.

Exhibit 5: Factor block contributions to active returns

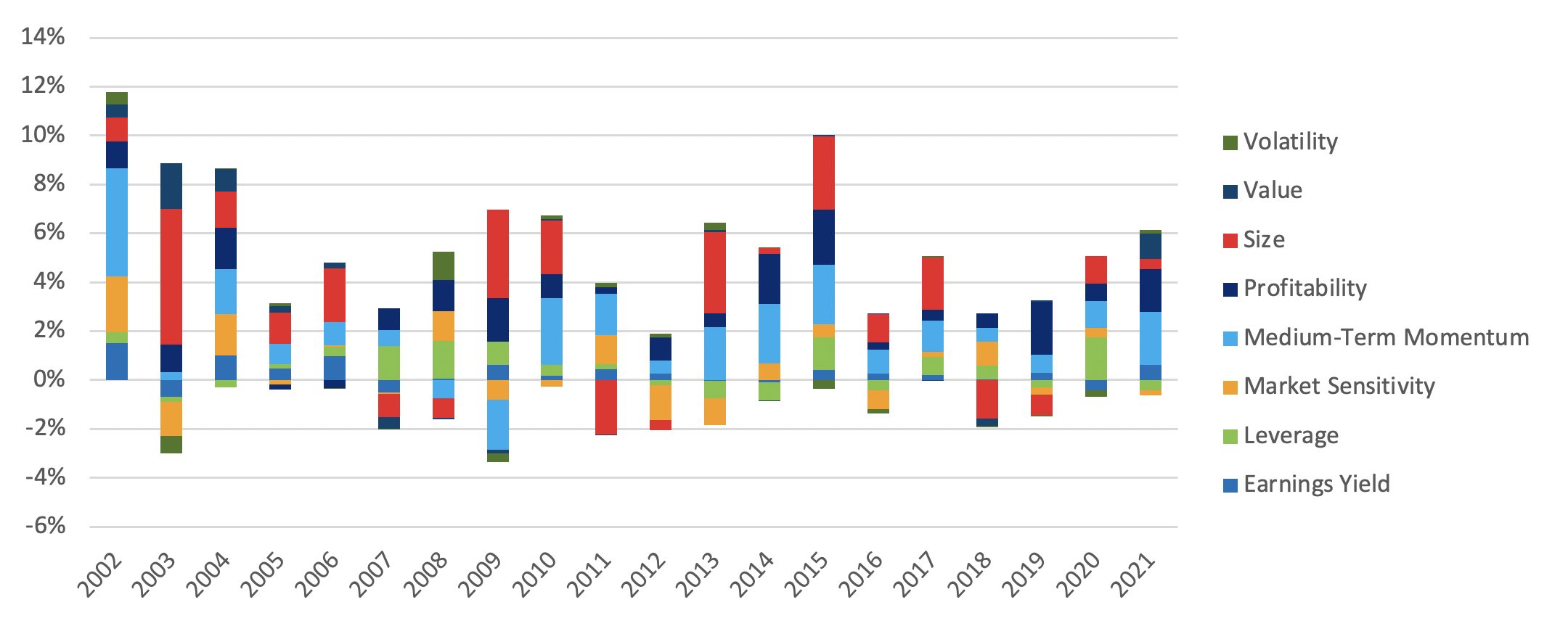

Exhibit 6 shows a bit more detail about the annual return contributions from the style tilts. As noted, each factor had its day in the sun. The benefits of diversification are also highlighted here. For example, Momentum had a rough time in 2009, but the small Size tilt offset most of the Momentum shortfall. The opposite was the case in 2011. There was only one year, 2002, when all styles contributed positively, but there were also no years where all styles failed simultaneously.

Exhibit 6: Individual factor contributions to active returns

Conclusion

The long-term advantage of investing in a style-based strategy is clear. The STOXX Europe 600 Industry Neutral Ax Multi-Factor index lagged the parent benchmark by any significant margin in only two of the last 20 years, and both instances were followed by a year of strong outperformance. Over time, the strategy has fared extremely well, and much of that consistent performance can be traced to the benefit of diversifying across factors. The style factors chosen for the index are based on sound principles that are the basis of many investment strategies, both quantitative and discretionary, and this index offers a disciplined way to access their returns.

Appendix 1: Definitions of targeted factors