STOXX has introduced the EURO STOXX 50® ESG DVP (Dividend Points) index, which calculates the dividends paid out by constituents of the EURO STOXX 50® ESG index during the annual period.

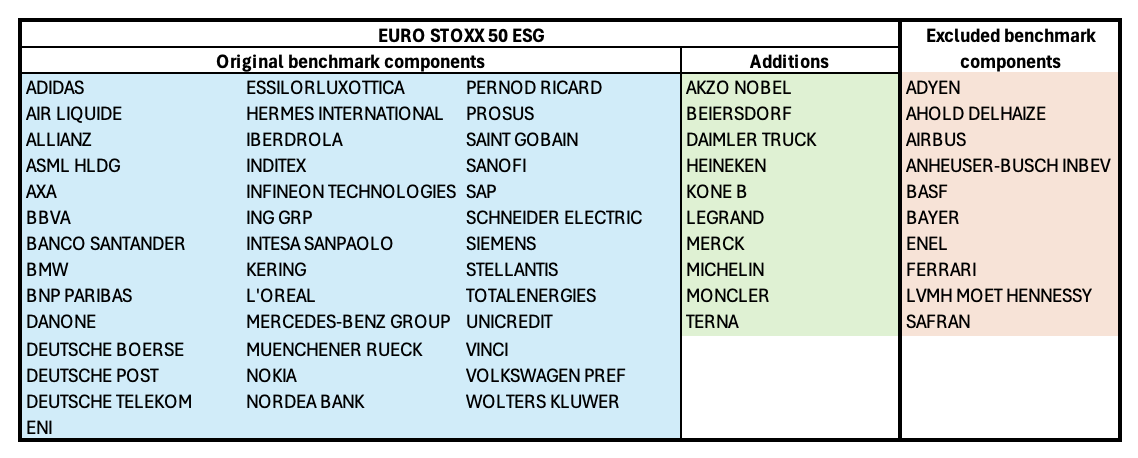

Dividend points indices allow market participants to strip off the dividend uncertainty from a benchmark. The EURO STOXX 50 ESG has become the Eurozone’s benchmark for investors who observe sustainability principles, as it removes from the standard EURO STOXX 50® those components that fail certain product-involvement and norms-based screens as well as those with the lowest ESG scores.[1]

Table 1: EURO STOXX 50 ESG components vs. benchmark

Futures based on dividend points indices are popular derivatives that allow investors and traders to gain targeted exposure on corporate payments. As such, they can hedge their portfolios’ dividend risk, separate from the underlying share performance. The new EURO STOXX 50® ESG DVP index will enable the construction of hedges around dividend payments in the EURO STOXX 50 ESG.

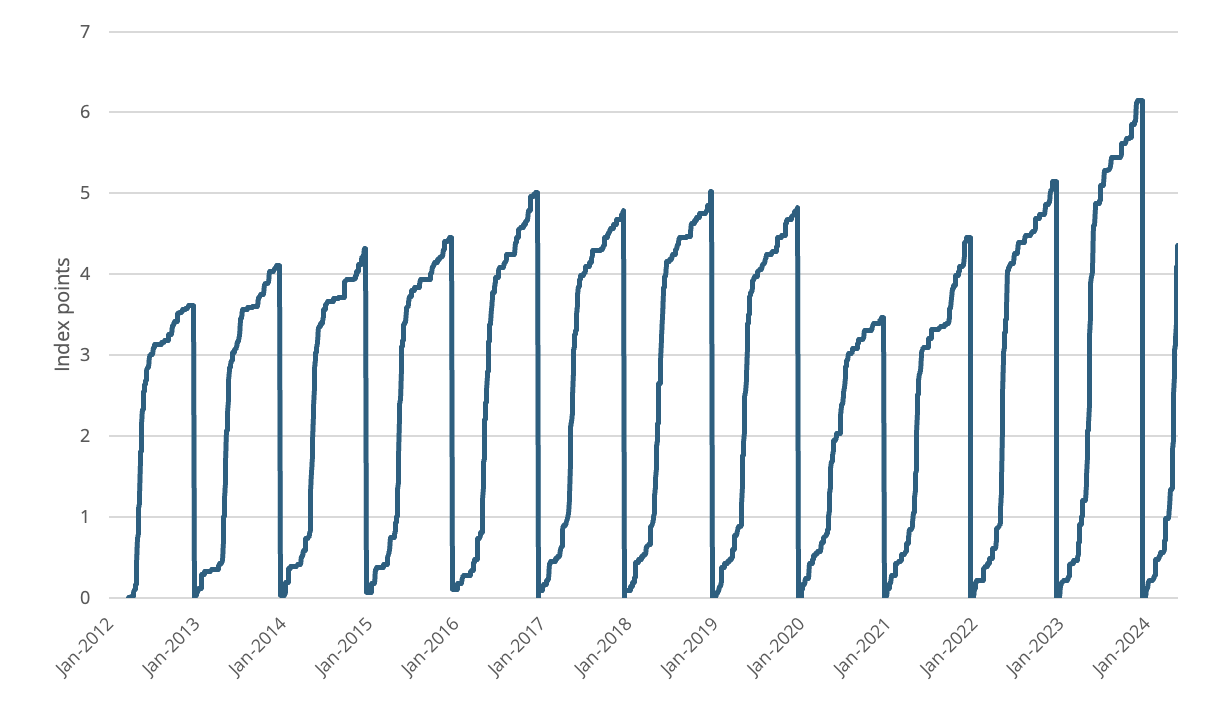

Dividend index points

The STOXX DVP indices are calculated as the sum of all gross cash or cash equivalent payments from the underlying index components each calendar year, where each payment amount is divided by the index divisor. The EURO STOXX 50 ESG DVP index has closed higher every year since 2021, indicating companies have boosted their payouts. The DVP index is reset to zero each year after the third Friday in December (Figure 1).

Figure 1: EURO STOXX 50 ESG DVP index price

In the case of the flagship EURO STOXX 50 benchmark, the EURO STOXX 50® Index Dividend Futures (FEXD ticker on Eurex) and EURO STOXX 50® Index Dividend Options (OEXD) have long been a trading staple on Eurex. The contracts settle to the annual value of the EURO STOXX 50® DVP index. Nearly 500,000 EURO STOXX 50 index dividend futures traded on average every month this year through April, for a total 2024 notional volume of EUR 29.7 billion.

In February this year, Eurex introduced mid-curve options (ticker: OED1-5) on EURO STOXX 50 index dividend futures.

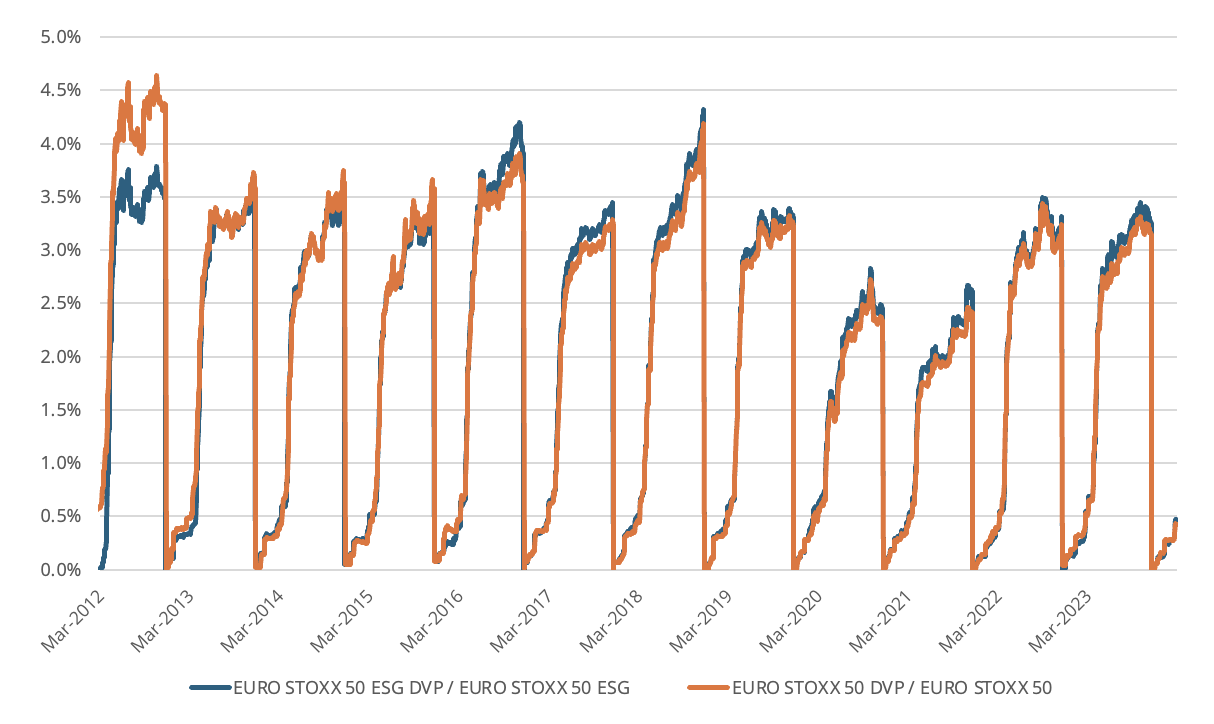

Last year, both the EURO STOXX 50 DVP and EURO STOXX 50 ESG DVP indices amounted to over 3% of the value of the respective underlying benchmark (Figure 2). The EURO STOXX 50 ESG DVP represented 3.25% of its benchmark while the standard EURO STOXX 50 DVP accounted for 3.15% of its reference index.

Figure 2: Relative level of DVP to underlying index

With this latest introduction, the trading ecosystem around the EURO STOXX 50 index and its sustainable version, the EURO STOXX 50 ESG, continues to grow. The benchmark lies at the center of an extensive suite of derivatives listed on Eurex, while futures and options on the EURO STOXX 50 ESG have been available on the exchange since November 2020.

[1] The EURO STOXX 50 ESG reflects the EURO STOXX 50 with standardized exclusion screens applied for Global Standards Screening, Controversial Weapons, Small Arms, Military Contracting, Thermal Coal, Unconventional Oil & Gas, ESG Controversies, ESG Risk and Tobacco. Furthermore, companies with the lowest ESG scores are excluded until a total of 20% (based on number of holdings) of the initial EURO STOXX 50 components are excluded. Each exclusion is replaced by a EURO STOXX company with a higher ESG score from the same ICB Supersector as the excluded company.