The STOXX® Europe 600’s 26th anniversary on June 15 found the index near an all-time high and reinforcing its standing as a bellwether for European equity markets.

Nearly EUR 53 billion[1] in fund investments track the index, which provides a broad yet investable representation of the region’s developed markets. A comprehensive family of strategies and investable products around the benchmark, meanwhile, keeps expanding amid evolving investor needs.

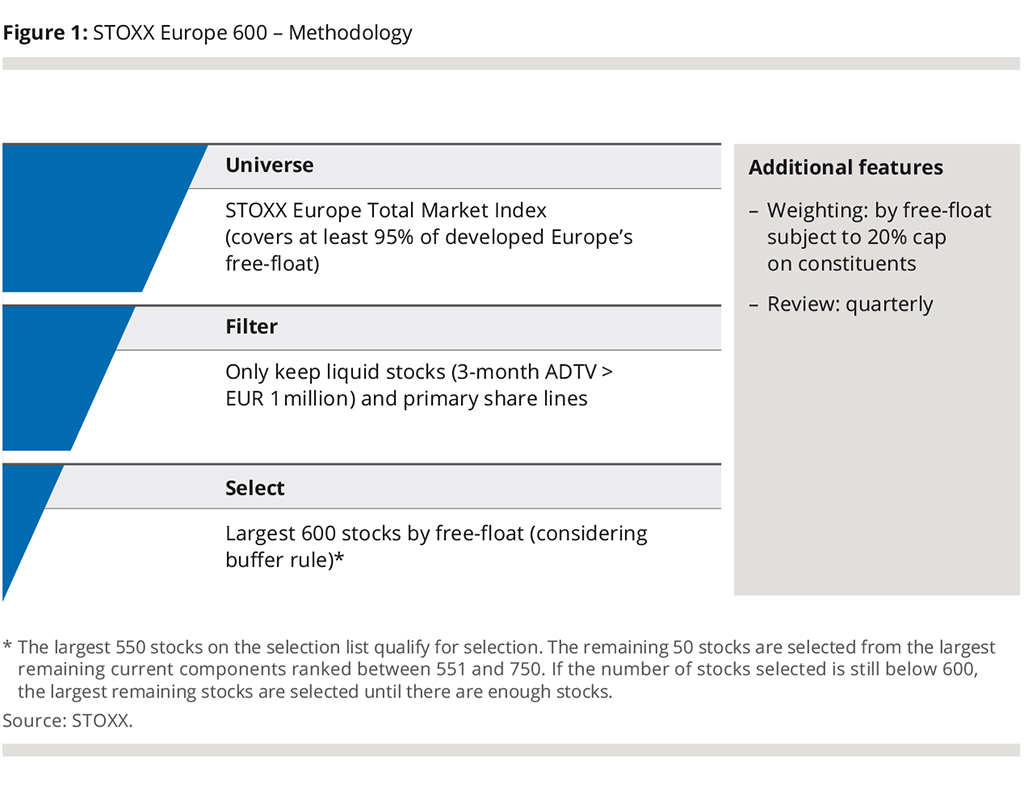

Methodology

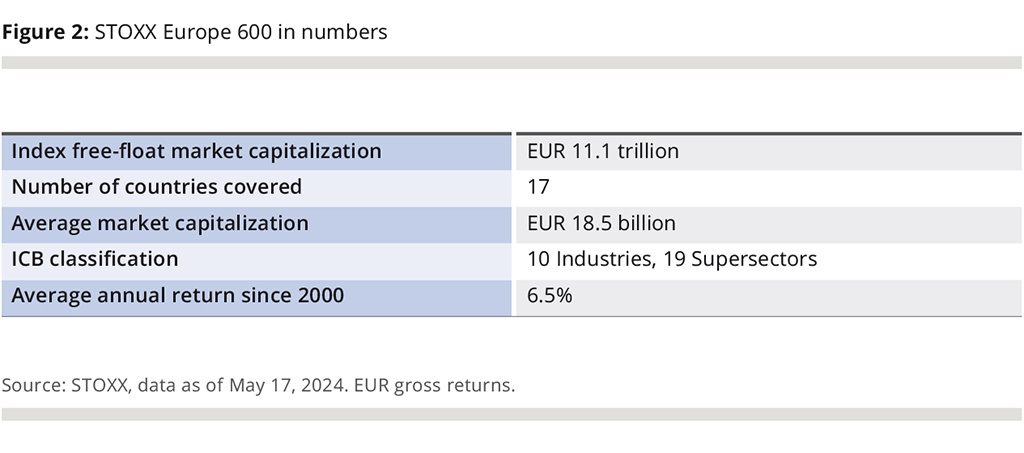

The STOXX Europe 600 is derived from the STOXX® Europe Total Market Index (TMI) and is a subset of the STOXX® Global 1800. With a fixed number of 600 components, the benchmark represents large-, mid- and small-capitalization companies across 17 countries,[2] — the widest coverage among flagship European benchmarks in the industry in terms of market capitalization and number of components.[3]

A liquidity filter[3] supports the tradability of the index’s portfolio, while a quarterly review based on clear rules gives it a continuous pulse on market changes. A buffer rule ensures a moderate turnover at each review.

The STOXX Europe 600’s free-float market cap has surpassed EUR 11 trillion after the index reached an all-time high in 2024 (Figure 2).

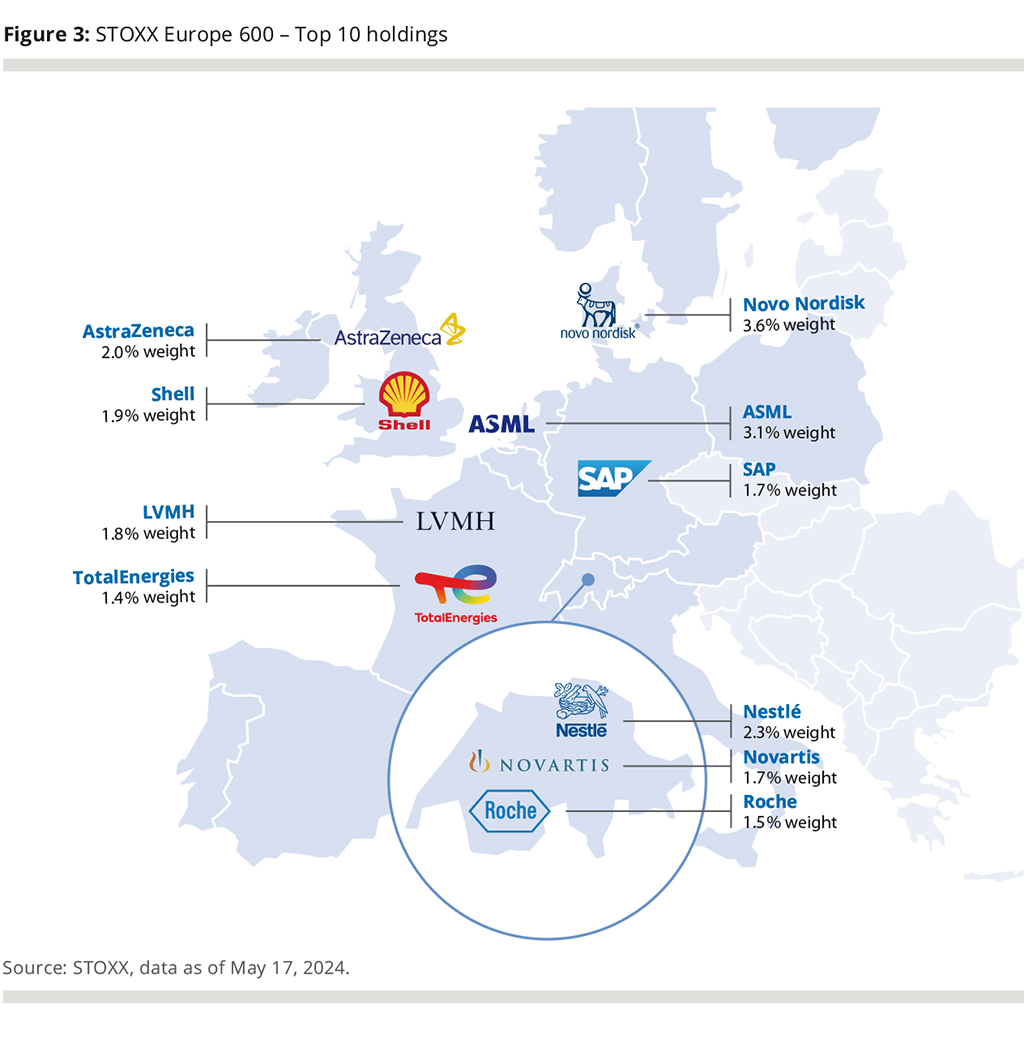

The index composition reflects Europe’s geographically diversified corporate profile (Figure 3).

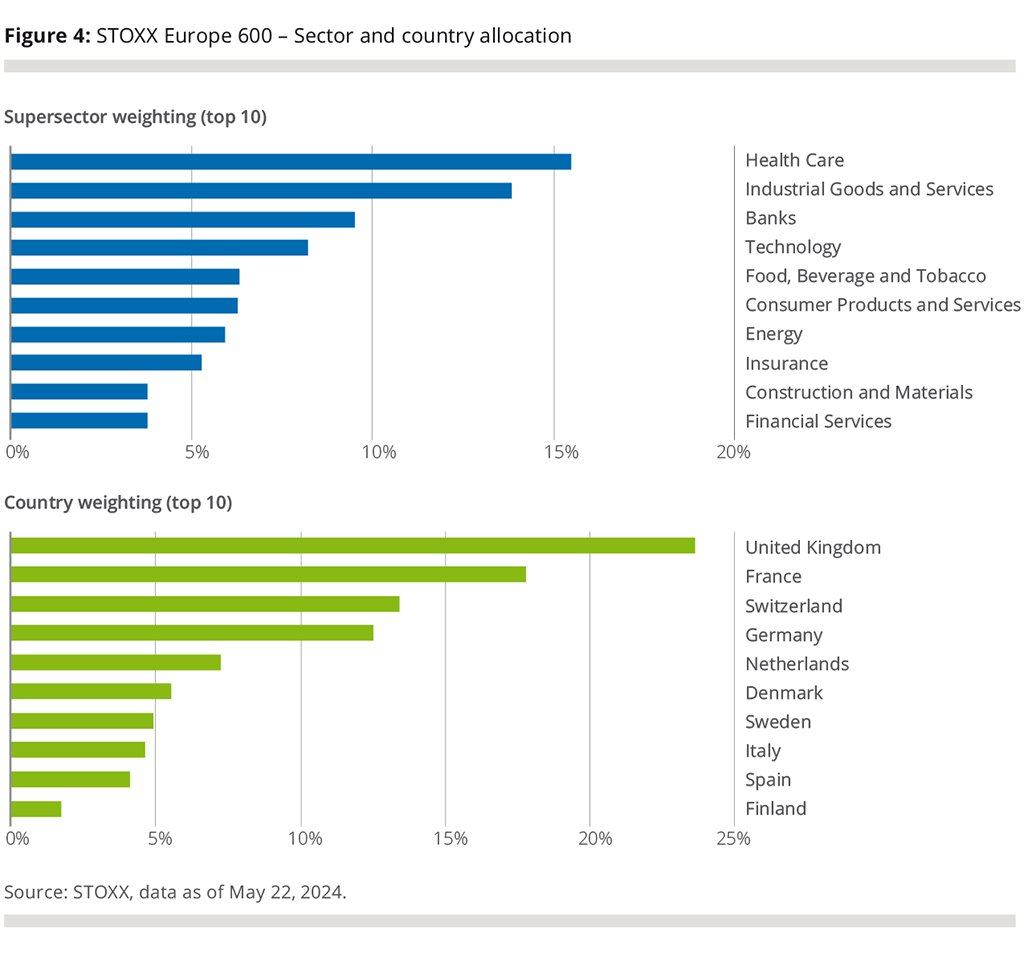

UK and Health Care stocks have the largest weightings in the STOXX Europe 600 benchmark, although other countries and ICB Supersectors have big representations too (Figure 4).

Expanded possibilities

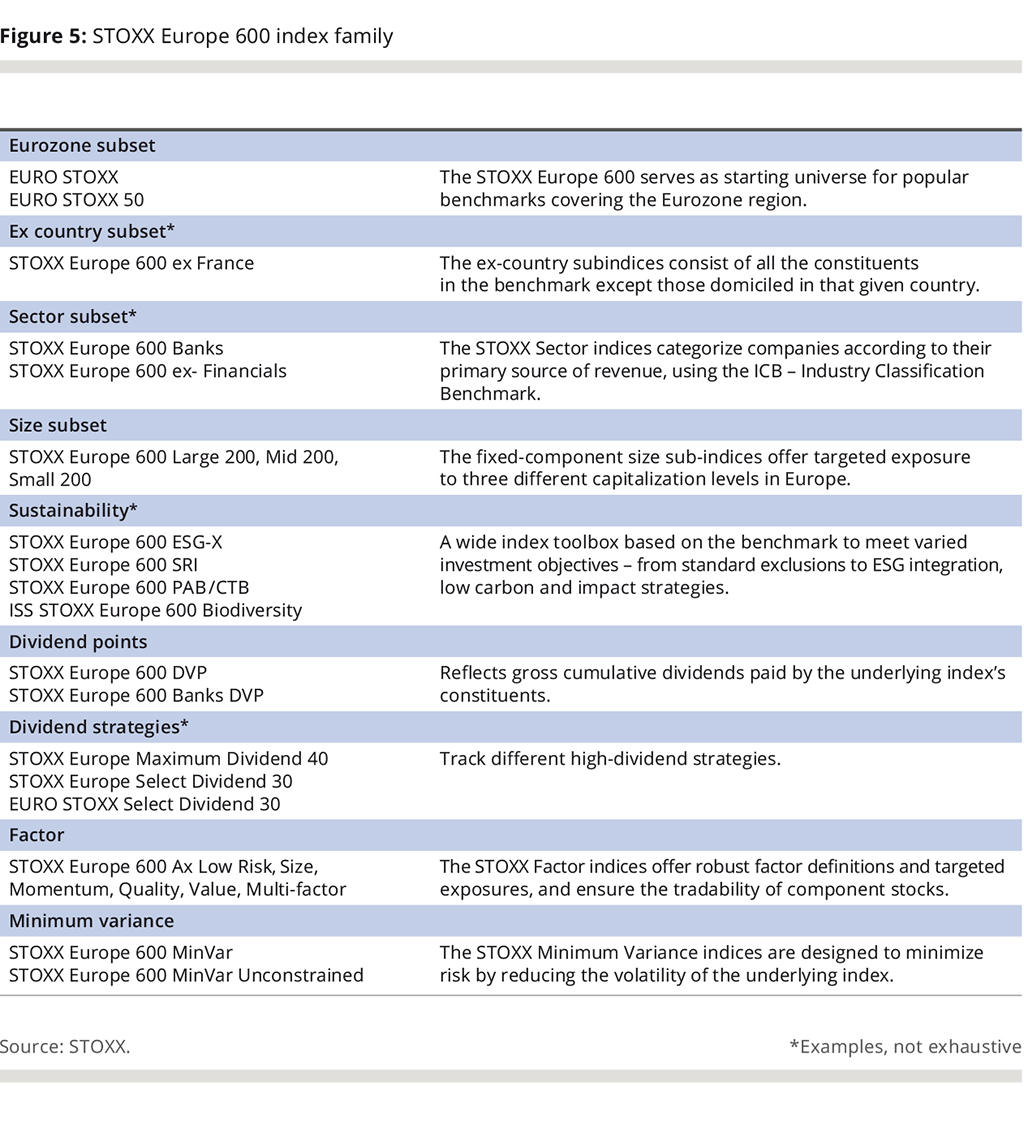

A suite of index subsets around the benchmark allows investors to target specific objectives in the European equity market, including sustainability, factor and sector strategies (Figure 5). The STOXX Europe 600 is also the starting universe for the blue-chip STOXX® Europe 50, and the Eurozone’s EURO STOXX® and EURO STOXX 50® indices.

Investment products landscape

Because of its transparent and rules-based construction methodology, the STOXX Europe 600 has become a favorite for asset managers and issuers to offer products that help investors efficiently access the European equity market, and hedge and manage portfolios.

The index and its sub-indices underlie EUR 28 billion in 64 ETFs.[5] Separately, EUR 25 billion invested in mutual funds are benchmarked to the index.[6]

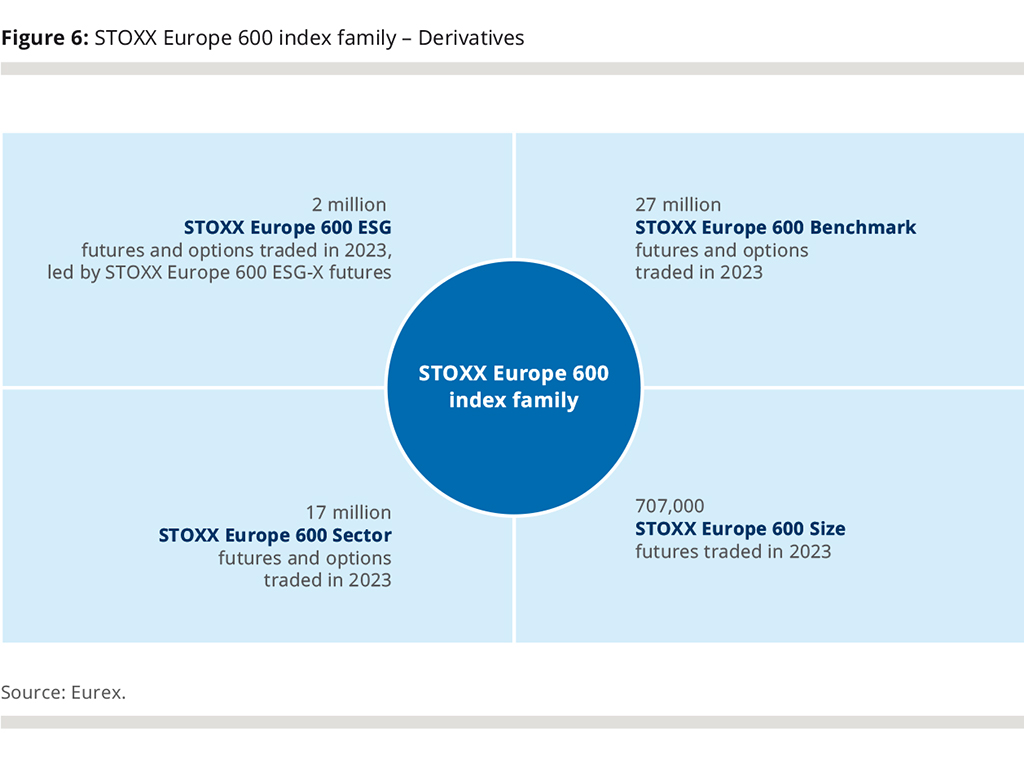

Nearly 47 million futures and options contracts on the STOXX Europe 600 and its subsets were traded on Eurex in 2023, with nearly EUR 1 trillion in notional volume. Europe’s largest derivatives exchange offers products on STOXX Europe 600 sector, sustainability and size strategies to meet investor demand for hedging and managing portfolio flows (Figure 6).

The variety of trading and investing possibilities in the STOXX Europe 600 index family through ETFs and mutual funds, structured products and exchange-traded derivatives shows the benchmark’s resilient ecosystem.

Sustainability moves to the fore

Increasing demand for responsible policies has defined institutional investing in recent years as regulators and asset owners raise the bar on issues from climate to biodiversity and social inclusion.

STOXX’s pioneering responsible investing segment dates back to 2001. In 2019, the suite yielded Europe’s first sustainability-focused futures, tracking the STOXX® Europe 600 ESG-X, which are among the world’s preeminent sustainable derivatives. Due to the success of the futures, Eurex introduced options on the index immediately after.

Since January 2024, there are also futures on the STOXX® Europe 600 SRI, which employs negative exclusions and integrates a best-in-class ESG approach.

The introduction of the STOXX® Europe 600 Paris-Aligned and STOXX® Europe 600 Climate Transition benchmarks, and of the ISS STOXX® Europe 600 Biodiversity index, has expanded the possibilities to invest in sustainable products.

Evolving landscape

The STOXX Europe 600 has gained large adoption since its inception in June 1998 by providing investable exposure to the region. More strategically, overseas investors have used the index to diversify global portfolios.

As the nature of index-based investing continues to change, benchmarks are now used as a toolbox with which to build customized strategies. The family of indices derived from the STOXX Europe 600 and the trading vehicles around it will continue to grow as STOXX caters to the increasingly tailored needs of investors.

Related articles

European benchmarks – the STOXX ecosystem

Europe’s ‘GRANOLAS’ overtake US ‘Magnificent Seven’ in performance

New STOXX Europe 600 SRI futures on Eurex broaden sustainable derivatives offering for investors

[1] Source: ETF Book, Morningstar Direct.

[2] Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

[3] Based on index market capitalization.

[4] Stocks must have a minimum liquidity of greater than EUR 1 million measured over the 3-month average daily trading volume (ADTV).

[5] Source: ETF Book. Data as of May 28, 2024.

[6] Source: Morningstar Direct, data through February 2024.