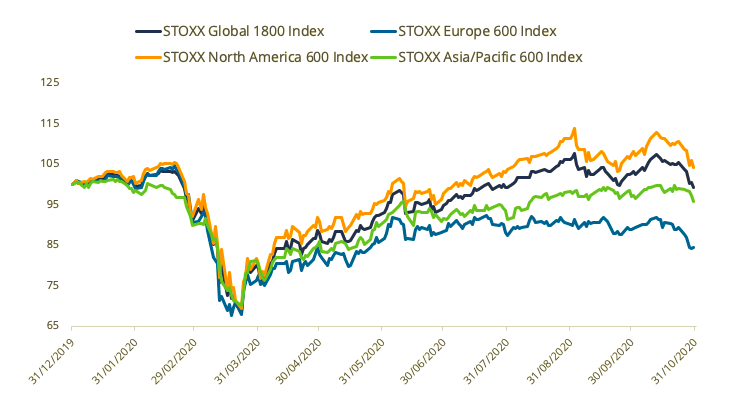

The STOXX® Global 1800 Index fell for a second consecutive month in October as governments resumed lockdowns amid a rebounding number of COVID-19 infections.

The global equity index declined 3.2% in dollar terms1 during the month and is now down 0.7% in 2020.

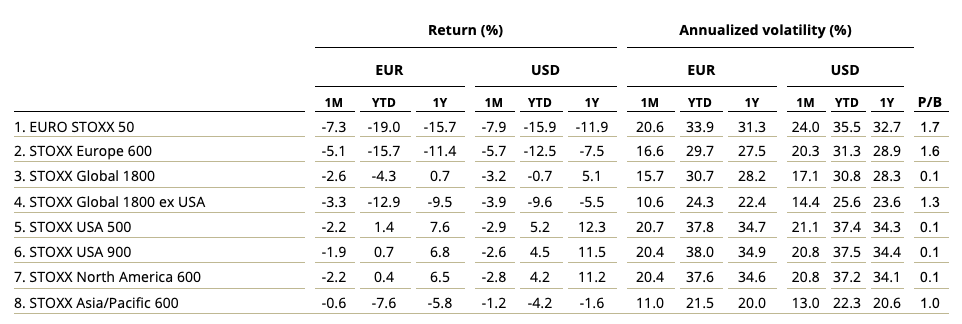

The pan-European STOXX® Europe 600 Index lost 5.1% when measured in euros, while the Eurozone’s EURO STOXX 50® Index shed 7.3%, both posting their worst month since March, when the COVID-19 crisis gathered pace in Europe and the US. The STOXX® North America 600 Index retreated 2.8% in dollars in October and the STOXX® USA 500 Index fell 2.9%. The STOXX® Asia/Pacific 600 Index decreased 1.2% in dollars.

The EURO STOXX 50® Volatility Index, or VSTOXX®, climbed to 40 on Oct. 29, its highest level since June. The reading of volatility for Eurozone shares ended September at 26.

Threat to global growth

France and Germany are among countries that tightened restrictions to economic and social activities last month to contain the COVID-19 pandemic. The curbs are likely to reduce economic and earnings growth forecasts for 2020, many companies warned as they released their third-quarter results in October.

In the US, investors also face the prospect of a change in government as Americans were set to choose between President Donald Trump and Democrat challenger Joe Biden in the Nov. 3 election. Mr. Biden commanded a lead in polls, although the vote could hinge on results in few battleground states.

Exhibit 1 – Returns since start of 2020

Exhibit 2 – Benchmark indices’ October risk and return characteristics

Emerging markets index posts gain

All but four of the 25 developed markets tracked by STOXX slid during October when measured in dollars. The STOXX® Poland Total Market Index paced declines for a second month, falling 14.5%. The STOXX® Developed Markets 2400 Index shed 2.9% in dollars and 2.3% in euro terms.

By contrast, the STOXX® Emerging Markets 1500 Index gained 0.7% in dollars. Ten of 21 national developing markets tracked by STOXX managed a positive return during the month, led by the STOXX® Indonesia Total Market Index’s 9.1% advance. The STOXX® Greece Total Market Index dropped the most, shedding 11.5%.

All but two of 20 Supersectors in the STOXX Global 1800 Index fell in the month. The STOXX® Global 1800 Energy Index dropped 5.2%, followed by declines in gauges tracking the Healthcare (-5%) and Food, Beverage and Tobacco (-4.9%) Supersectors. The two exceptions to the losing trend were the STOXX® Global 1800 Utilities Index, which climbed 1.3%, and the STOXX® Global 1800 Banks Index, which added 1.2%.

Factor-based strategies

Among the STOXX Factor Indices, the STOXX® Global 1800 Ax Size Index (-0.3%) stood out during October, significantly outperforming its benchmark and all other styles. In Europe, however, the STOXX® Europe 600 Ax Momentum Index (-1.7%) did better than all other factor indices, while the STOXX® Europe 600 Ax Low Risk Index (-4.7%) came out last in the group.

Within the STOXX® ESG-X Factor Indices, the STOXX® Global 1800 ESG-X Ax Size Index outperformed the most, even if it still lost 1% in the month. The ESG-X Factor indices implement the same factor-based methodology of the STOXX Factor Indices, seeking exposure to five style signals, but do so on slightly smaller universes that exclude stocks based on the responsible polices of leading asset owners.

Factor Market Neutral and Premia indices

There were mixed performances in October from the iSTOXX® Europe Factor Market Neutral Indices, which hold a short position in STOXX Europe 600 futures to help investors neutralize systematic risk. The iSTOXX® Europe Carry Factor Market Neutral Index was the month’s best performer after adding 1.2% on a net-return basis.

Elsewhere, seven of the eight EURO STOXX® Multi Premia® and Single Premium Indices outperformed the benchmark EURO STOXX® Index (-5.7%) in the month that ended. The exception was the EURO STOXX® Value Premium Index, which lost 6.2%.

Sustainability strategies

The STOXX® Global 1800 ESG-X Index (-3.2%) came up broadly in line with its benchmark during October, allowing investors to generate market-type returns while complying with sustainable policies. The EURO STOXX 50® ESG-X Index (-7.6%) underperformed its benchmark.

The EURO STOXX 50® ESG Index (-7.6%) lagged its benchmark by 34 basis points. The ESG index, which is derived from the iconic EURO STOXX 50 and incorporates negative exclusions and ESG scoring into stock selection, has beaten its benchmark by more than 3 percentage points so far in 2020.

The DAX® 50 ESG Index, which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, fell 8.7% and extended its outperformance streak relative to the flagship DAX® (-9.4%).

Climate benchmarks

The STOXX Paris-Aligned Benchmark Indices (PABs) and the STOXX Climate Transition Benchmark Indices (CTBs) came up behind their benchmarks during October.

The PAB indices are based on liquid securities from a selection of STOXX benchmark indices and follow the EU Paris-aligned Benchmark (EU PAB) requirements outlined by the European Commission’s Technical Expert Group (TEG) on climate benchmarks.

The CTBs, which also follow the requirements outlined by the TEG, form portfolios that are on a decarbonization trajectory. The PAB and CTB indices were introduced in June.

Minimum variance

Minimum variance strategies helped limit losses in global and European portfolios during the month that ended. The STOXX® Global 1800 Minimum Variance Index lost 1.6%, while the STOXX® Global 1800 Minimum Variance Unconstrained Index fell 1.3%. The STOXX® Europe 600 Minimum Variance Index dropped 4.3% and its unconstrained version lost 4.4%.

The STOXX® Minimum Variance Indices come in two versions. A constrained version has a similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

Thematic indices

The STOXX® Thematic Indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven. Thirteen of 22 STOXX revenue-based thematic indices outperformed the STOXX Global 1800 Index during October.

Four of them had a positive return in the month, led by the STOXX® Global Electric Vehicles & Driving Technology Index’s 1.4% advance. At the other end, the STOXX® Global Fintech Index shed 6.8%.

Year-to-date, the STOXX® Global Smart Cities Index is the best-performing gauge in the STOXX Thematics family, having risen 41.6% despite a 3.1% pullback in October.

Two of three STOXX artificial-intelligence-driven thematic indices, the STOXX® AI Global Artificial Intelligence Index (-2.5%) and its ADTV5 version (-2.4%), continued their streak of outsized relative returns during October.

Featured indices

STOXX® Global 1800 Index

EURO STOXX 50® Index

STOXX® Europe 600 Index

STOXX® North America 600 Index

STOXX® Asia/Pacific 600 Index

STOXX® USA 500 Index

STOXX® Developed Markets 2400 Index

STOXX® Emerging Markets 1500 Index

STOXX® Global 1800 Minimum Variance Index

STOXX® Europe 600 Minimum Variance Index

STOXX® Factor Indices

STOXX® ESG-X Factor Indices

iSTOXX® Europe Factor Market Neutral Indices

EURO STOXX® Multi Premia® and Single Premium Indices

EURO STOXX 50® ESG Index

DAX® 50 ESG Index

STOXX® Paris-Aligned Benchmark Indices

STOXX® Climate Transition Benchmark Indices

STOXX® Global Climate Change Leaders Index

STOXX Thematic Indices

1 All results are total returns before taxes unless specified.