The ‘Next Generation ESG Derivatives’ webinar, organized by Risk.net and Eurex on October 14, covered the surge in trading in sustainability-focused derivatives in Europe.

Starting only a couple of years ago with the listing of the first futures, demand for ESG derivatives has taken off as investors and traders turn to the instruments to hedge and manage ESG-compliant portfolios.

Steffen Hoerter, Head of ESG at Munich Re Investment Partners, explained during the event that asset managers are increasingly using ESG derivatives for a whole menu of purposes, including risk management, cost savings and price discovery. He said that an ‘optimized triangle’ of liquidity, transaction costs and sustainability quality can make ESG derivatives the right instruments to manage sustainable portfolios.

“ESG derivatives are a great addition to the sustainable investment universe,” said Hoerter. “We all know of the advantages of derivatives, including savings of transactions costs, efficiencies and consistency for sustainable investors.”

Hamish Seegopaul, Head of R&D, ESG and Quantitative Indices at Qontigo, also took part in the on-line panel and gave the index provider’s perspective on the outlook for ESG derivatives.

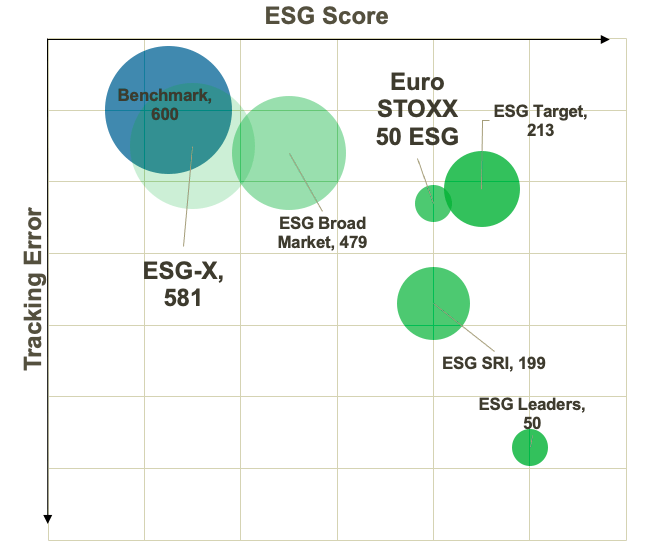

According to Seegopaul, a recent feature in the growth trajectory for ESG products is the widening menu of choices, helped by advancements in data and technology. With more investment alternatives, investors must assess where their desired equilibrium between sustainability level and active risk lies, he explained.

“When it comes to index methodologies, the design parameters have consequences,” he said. “There is a clear trade-off in terms of integrating more sustainability criteria and incurring tracking error, which can be a key consideration for benchmark-oriented investors.”

Figure 1 shows where this trade-off lies across various sustainability strategies. The STOXX® Europe 600 ESG-X Index (an exclusions-only strategy) sits the closest to the benchmark STOXX® Europe 600 Index both in tracking error and ESG score. As the strategies incorporate more sustainability criteria — for example, the EURO STOXX 50® ESG Index (exclusion + integration) and the EURO STOXX® ESG Leaders 50 Index (best-in-class) — the indices move further to the right and down. In other words, the higher the sustainability ambition, the higher the tracking error.

Figure 1 – Trade-off between active risk and sustainable objective

As the number of objectives – both financial and sustainable – increase, the management of trade-offs becomes more important, and requires more sophisticated portfolio-construction techniques like optimization, said Seegopaul.

Increasing demand

Yet, despite the increasing sophistication, the most interest is still being directed at standard exclusions-only strategies. Trading in STOXX® Europe 600 ESG-X Index (FSEG) futures, the world’s most popular sustainability-focused derivatives, has topped 1.4 million traded contracts this year on Eurex. STOXX’s ESG-X indices exclude companies in breach of Sustainability’s Global Standards Screening, as well as those involved with controversial weapons, thermal coal and tobacco.

Other STOXX and DAX indices underlying derivatives at Eurex include the STOXX® USA 500 ESG-X, STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco, EURO STOXX 50® Low Carbon, STOXX® Europe ESG Leaders Select 30 and DAX® 50 ESG. Overall, the entire STOXX and DAX ESG suite of derivatives at Eurex has topped 4 billion euros in open interest.

A challenge: Europe’s regulatory jungle

The panel also covered regulation, a topic of ongoing debate as the European Commission pushes ahead with its Action Plan on green finance and national policymakers incorporate their own regulation.

“When it comes to sustainability, we are still operating in a fairly fragmented regulatory environment in Europe,” said Qontigo’s Seegopaul. “That makes standardization difficult for issuers, index designers and investors. You may be required to pick and choose which labels you would like to adhere to.”

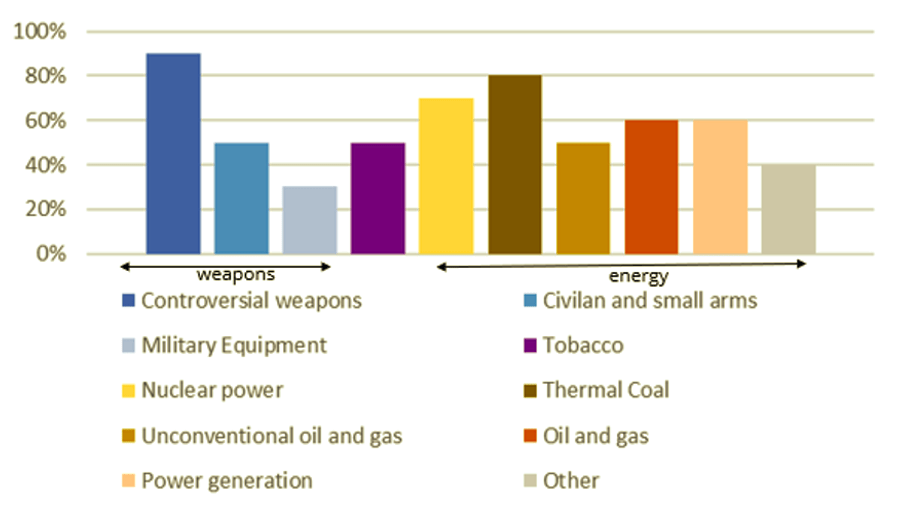

Figure 2 gives just one example of this label jungle by showing the lack of uniformity among a selection of European sustainability labels when it comes to product-involvement exclusionary policies. While the screening of controversial weapons satisfies over 80% of regional and national sustainability product labels in Europe, military equipment is a required exclusion in only roughly a quarter of them.

Figure 2 – Popularity of product involvement screens

As an example of product evolution that this may spur, the EURO STOXX 50 ESG index’s methodology was updated this year to keep the index aligned with evolving sustainability practices and new regulatory guidelines. The number of replaced ESG laggards and sustainability screens violators was raised to 20% of benchmark constituents from 10%, and two new exclusions — companies involved in military contracting and in tobacco distribution — were introduced. The new methodology lifted the ESG score of the ESG index, but also increased its returns and tracking error relative to the benchmark.

The landscape ahead

Looking ahead, one trend that is gaining pace is investors’ focus on portfolio impact and real-world outcomes. Exclusion-focused strategies still see a great deal of interest, Seegopaul explained. However, increasing awareness and work around investment action to secure real, positive sustainable outcomes is a key topic of discussion, he added.

Talking during the presentation, Achim Karle, Vice President for Global Equity & Index Sales EMEA at Eurex, said he expects a third phase of ESG derivatives listing to unfold next, covering socially responsible investment (SRI) and impact strategies. The former consider both financial returns as well as social/environment good, while the latter focus on companies that are aiming to solve sustainable development goals (SDGs).

The panelists predicted more growth and new milestones in the ESG derivatives market in the next couple of years, as regulation changes and investors increase allocations. Emerging data sets and ever-more intelligent index design will enable a new generation of solutions, they said.

“There are many exciting developments around data, and modelling of what the future looks like,” said Seegopaul. “Injecting those into strategies is one of the exciting areas of index development. But there is also work ahead of us in terms of making sure the choices we give to investors are aligned with evolving regulation and practices.”