As the price of crude oil slumped below zero this month, one segment of the equity market got a boost from the unprecedented situation.

Benchmark US oil contracts for immediate delivery1 fell to minus $40.32 a barrel on Apr. 20, the first time ever they registered a negative value. The unusual pricing, which technically means producers are paying buyers to take the commodity off their hands, reflects the severe deterioration in global economic activity. As demand for oil slumps worldwide, producers are struggling to find storage for their surplus.

Cue in oil tankers, traditionally transporters of crude but these days acting more and more as floating storage units.

Reuters reported on Apr. 17 that traders are storing an estimated record 160 million barrels of oil on ships — double the level from two weeks earlier — in what is believed to be history’s biggest oil glut.2 The volume of oil stored on ships has jumped 70% since the beginning of March, according to energy researcher Kpler. Reports abound of vessels with crude cargo sitting idle offshore around the globe.

To assess how shares of oil-tankers operators are faring amid this industry phenomenon, we created a hypothetical index with the help of iSTUDIO™ that tracks these companies.3 The index is made up of all stocks within the STOXX® Global Total Market Index4 that generate at least 10% of revenue from the Petroleum Water Transportation business category in FactSet’s Revere Business Industry Classification System (RBICS).

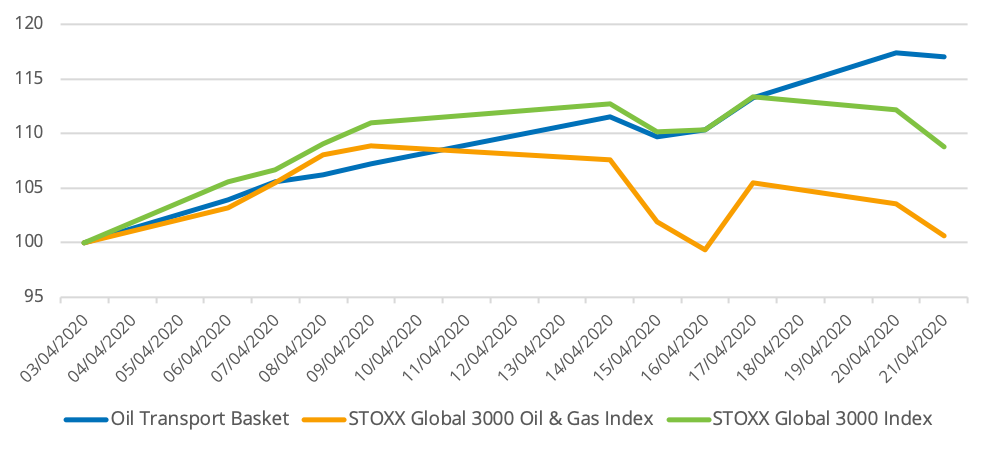

Chart 1 shows the performance of the custom tankers basket against the STOXX® Global 3000 Index and the STOXX® Global 3000 Oil & Gas Index since Apr. 3.

Chart 1

The oil-transport group, which consists of 22 companies including Frontline and American Shipping Co., gained 17.1% from the close on Apr. 3 through Apr. 21, nearly twice as much as the broader market defined by the STOXX Global 3000 Index. The energy sector, represented by the STOXX Global 3000 Oil & Gas Index, was almost unchanged for the period.

The oil-tanker basket did particularly well in absolute and relative terms as oil prices turned south. Between Apr. 9 and Apr. 20, West Texas Intermediate (WTI) crude fell almost every day, going from $25.09 a barrel to a closing price of minus $37.63 on Apr. 20. Between Apr. 9 and Apr. 21, the oil-transport group rose 10.3% in total while the STOXX Global 3000 Oil & Gas Index fell 6.9%.

Crude Oil Contango

Tankers are benefitting from the scramble for storage exacerbated by a peculiar situation in the oil futures market. Due to the current economic uncertainty, the derivatives are in contango, meaning the front contracts are cheaper than those with a later expiration. That means that traders can buy crude today, store it for some time and sell it a higher price in the future.

Things could get worse for producers before they get better. The International Energy Agency forecast this month5 that at the current rate, the oil stock build-up could saturate storage capacity by mid-year, overwhelming the logistics of the oil industry (ships, pipelines and tanks).

“Floating storage is becoming more expensive as traders compete for ships,” the IEA said in its April Oil Market Report. “Chartering costs for Very Large Crude Carriers (VLCCs) have more than doubled since February. Never before has the oil industry come this close to testing its logistics capacity to the limit.”

Jonathan Chappell at Evercore ISI told Reuters6 that oil tankers are, for now, in the right place amid turbulent markets.

“The eventual wind down of this inventory glut will be most painful to tanker demand, but in the meantime floating storage remains the only outlet for a mismatched production and consumption backdrop,” Chappell was quoted as saying.

1 Price for May futures of West Texas Intermediate (WTI).

2, 6 Reuters, ‘Crude oil held in sea storage hits new record at 160 million bbls: sources,’ Apr. 17, 2020.

3 STOXX iSTUDIO is an integrated development application that allows users to build their own indices.

4 The STOXX® Global Total Market currently consists of 9,149 stocks and represents 95% of the free float market capitalization worldwide.

5 IEA, Oil Market Report – April 2020.