STOXX has announced the results of the annual review of the STOXX® Global ESG Leaders Index, with Japan, Germany and Hong Kong providing the most entrants to the benchmark of corporate sustainability champions.

A total of 91 companies made it into the benchmark, including Germany’s Siemens AG, Japanese financial-services company Mizuho Financial Group Inc. and US consumer-goods maker Colgate-Palmolive Co. Meanwhile, 78 companies were deleted.

While Europe dominates the universe of corporate responsibility leaders, the latest review helps Asian and North American companies narrow the gap. A total of 35 Asian companies made it into the Global ESG Leaders Index, while 20 exited. Twenty US and Canadian stocks were promoted, while a total of 17 companies from the countries left. Thirty-six European companies entered the index, less than the 41 that exited.

The STOXX Global ESG Leaders Index is STOXX’s broadest benchmark tracking the highest-achievers in environmental, social and governance (ESG) policies. The index, which currently has 404 constituents, is derived from individual gauges covering each ESG category.

A thorough analysis of sustainability data

The STOXX Global ESG Leaders Index is compiled based on ESG indicators from research firm Sustainalytics, which performs continuous analysis using company data, media reports and sector and public studies.

Sustainalytics has defined a set of indicators for each one of the three ESG criteria and allocates a score ranging from 0 to 100 for each indicator. The single indicator scores are aggregated into a total rating per ESG criterion using a weighted sum, where both indicators and weight are adjusted to reflect industry idiosyncrasies.

The ratings form the basis for calculating an overall ranking for each ESG category and finally for entry into the specialized ESG indices and the overarching STOXX Global ESG Leaders Index. The latter comprises all components eligible for at least one of the specialized indices and is sustainability score-weighted.

Industrials, Japan dominate new entrants

New constituents in the latest review also include Pirelli SpA, Nippon Prologis REIT Inc., ON Semiconductor, Boliden AB, Fraport AG, Sumitomo Mitsui Trust Holdings Inc., SCOR and WorleyParsons Ltd.

A total of 19 Japanese companies were included in the index and nine stocks from the country were removed, the highest net positive count for any country. Eight companies entered from Germany while four exited.

Hong Kong and Singapore also added to the net count for the Asia/Pacific region. Eight companies from the former entered the index while five exited. Singapore added four stocks while two from the nation were removed.

Denmark, France, Luxembourg, Spain, Switzerland and the UK each lost one net constituent, while Sweden and Italy lost two.

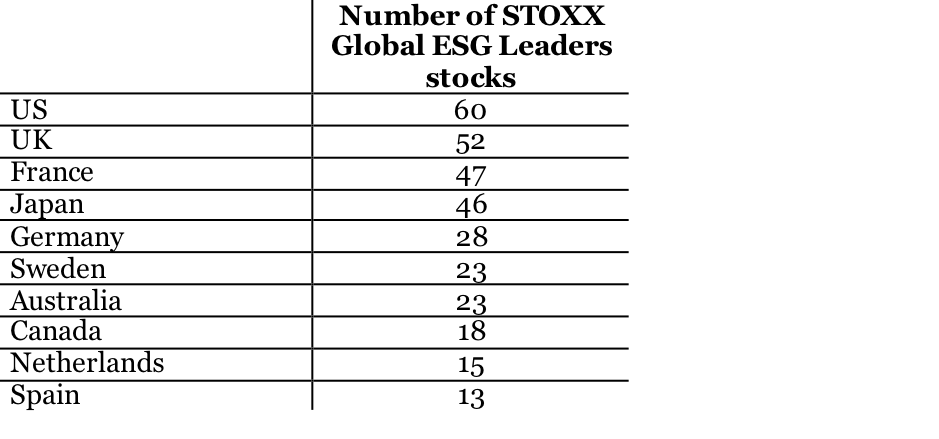

Table 1 shows the countries with the most STOXX Global ESG Leaders Index constituents.

Subsector and country representation

Industrial goods and services was the supersector with the most entrants, with 19, while real estate scored the highest net count of additions, at seven.

Following the review, industrial goods and services is the most represented supersector among 19 in the index, providing 59 constituents. It’s followed by real estate, with 39 constituents, and banks with 32. Automobiles and parts, at the other end, have only seven representatives in the index.

More than a quarter of the world’s $88 trillion assets under management were invested according to ESG principles as of 2017, said a report last year.1

Featured indices

STOXX®Global ESG Leaders Index

1 Institutional Investor, ‘McKinsey: ESG No Longer Niche as Assets Soar Globally,’ Oct. 27, 2017.