The STOXX® Minimum Variance Indices are designed to achieve the lowest return volatility in a given investable universe. Every index in the family is constructed via an optimization process using the Axioma optimizer, risk models and an estimated covariance matrix.

A new study1 by Qontigo examines whether the Minimum Variance indices can still deliver their risk-reducing properties once its main tool — the covariance matrix — is hampered by rising correlations in times of geopolitical uncertainty.

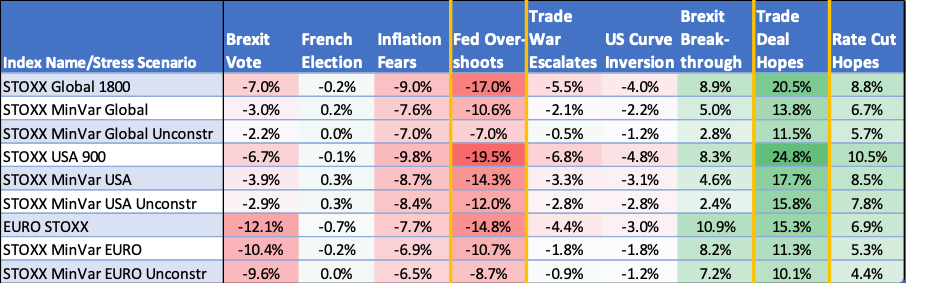

To answer this question, the authors looked at the stress tests from nine recent geopolitical events (first row of Table 1)2 for different versions of the Minimum Variance indices. The analysis is run on the STOXX® Global 1800 Minimum Variance Index, STOXX® USA 900 Minimum Variance Index, EURO STOXX® Minimum Variance Index, and respective unconstrained versions,3 as well as on their benchmarks.

Stress test results (Table1) show that the Minimum Variance indices protect portfolios by a significant margin in market downturns, at a cost of smaller underperformance relative to the respective benchmarks, during market upturns. Results also show that the unconstrained versions of the Minimum Variance, which are free to achieve more extreme risk reductions, offer superior downside protection.

Table 1

Sector and factor-style exposure and contribution

To dig deeper into the source of returns, the analysts decomposed the sector and factor-style exposures and contribution for the benchmarks and the Minimum Variance indices. In most cases, the Minimum Variance indices benefitted during downturns from being underweight in cyclical sectors such as information technology and, in some instances, industrials.

A world of increasing sources of risk

For readers interested in minimum variance’s long-term performance, the report also reviews the returns over the last decade. The results show that the indices consistently outperformed during market downturns and often outperformed in years of positive market returns. At the same time, they reduced volatility by as much as 40%, while limiting the depth and shortening the length of drawdowns.

Minimum Variance strategies can provide superior risk-return characteristics in times of market stress. While this is a welcome relief in an increasingly uncertain geopolitical world, investors should approach the strategies with full knowledge of the resulting portfolio constitution and characteristics.

Featured indices

- STOXX® Global 1800 Minimum Variance Index

- STOXX® USA 900 Minimum Variance Index

- EURO STOXX® Minimum Variance Index

1 D’Assier, O., Schon, C., Della Seta, M., ‘Minimum Variance: A Leg Up on Geopolitical Risk?’ Qontigo, October 2019.

2 The periods included in the analysis are: October 2018, when fears emerged that the US Federal Reserve was ‘overshooting’ in raising interest rates too fast; the three months from December 2018 during which the US and China were in promising trade negotiations; the run-up to the 2017 French presidential election; rising inflation fears in January 2018; an escalation of the trade war rhetoric between China and the US in May 2019; the inversion of the US Treasury yield curve in July 2019; the immediate aftermath of an initial ‘Brexit’ agreement in December 2017 between the UK and the European Union; and the period from May 2018 when expectations grew that the Fed would reverse some of its 2018 rate hikes.

3 The STOXX Minimum Variance Indices come in two versions: constrained and unconstrained. The former indices have a similar exposure to a market-cap index but with lower risk. Index construction rules are imposed to avoid extreme positionings arising from the risk minimization objective. The unconstrained version, on the other hand, has more freedom to fulfill its mandate of achieving the maximum possible risk reduction within the same universe of stocks.