In Asia, one market continues to stand out for its formidable gains.

The STOXX® India All Cap index has gained 20% so far this year[1] and is trading at a record high following the re-election of Narendra Modi as Prime Minister. Modi has overseen sustained expansion of consumption and economic reform, which has led to strong earnings growth at companies from Reliance Industries Ltd. to ICICI Bank Ltd.

While Modi’s party failed to win an outright majority in parliament in the June 4 vote, he will govern in a coalition, and investors have quickly overcome any disappointment about this result and looked to future profits growth.

India, the world’s fifth-largest economy and most populous nation, is benefitting from fast-improving socio-economic standards, urbanization, and off-shoring that has fueled foreign investment. The economy reached USD 3.6 trillion at the end of 2023, up from USD 1.9 trillion a decade earlier.[2]

The International Monetary Fund (IMF) has forecast the country will grow 7% in the current fiscal year,[3]more than previously estimated, and 6.5% a year after. Should it achieve that rate of expansion, the economy would have climbed 7.2% on average in the four years through 2025. That compares with an annual average of 4.4% over the same period for China.

Sustained gains

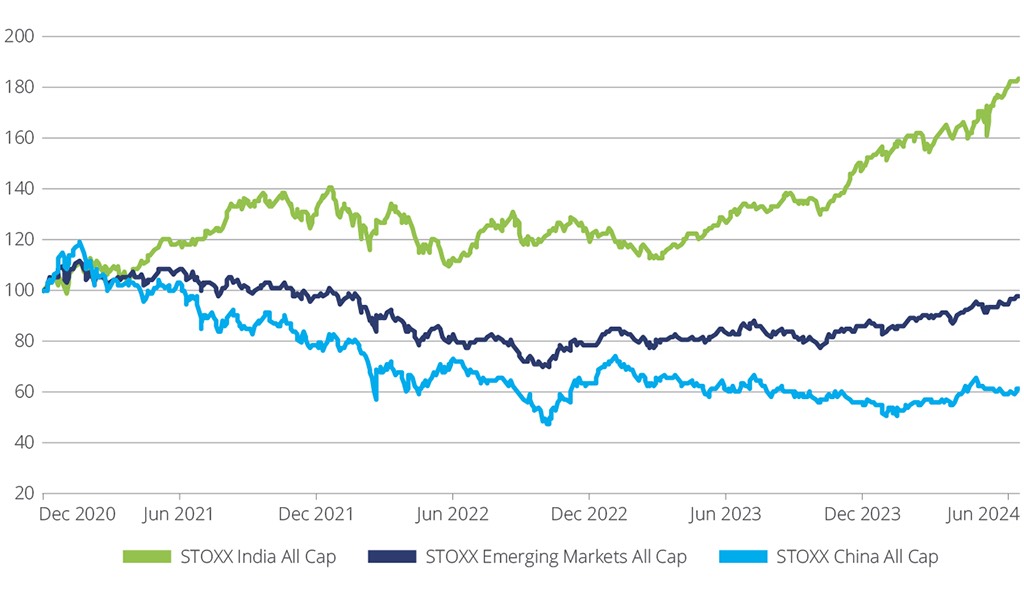

The STOXX India All Cap index has rallied 84% since the start of 2021, one of the steepest gains among all countries tracked by STOXX. That compares with a 2.1% retreat for the STOXX® Emerging Markets All Cap index. Meanwhile, the STOXX® China All Cap index has dropped 39% over the same period. (Figure 1).

Figure 1: Index performance

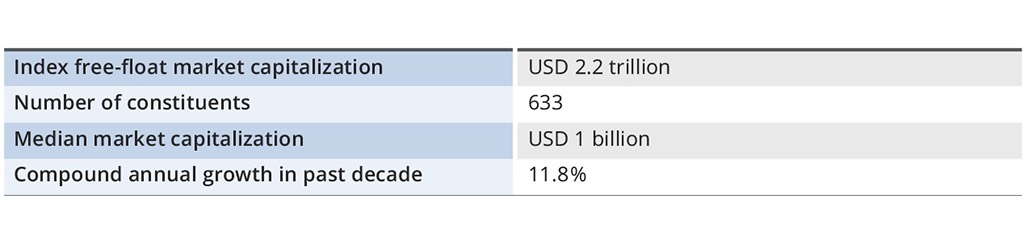

With 633 components, the STOXX India AC index is a broad benchmark that covers all size segments of the market, offering wider exposure to the market than do narrower indices. The index is derived from the STOXX® World AC, a modular benchmark that allows investors to slice and dice the world’s equity markets along region, country, size and sector. Indian stocks represent 2.4% of the STOXX World AC.

Figure 2: STOXX India All Cap in numbers

Index composition

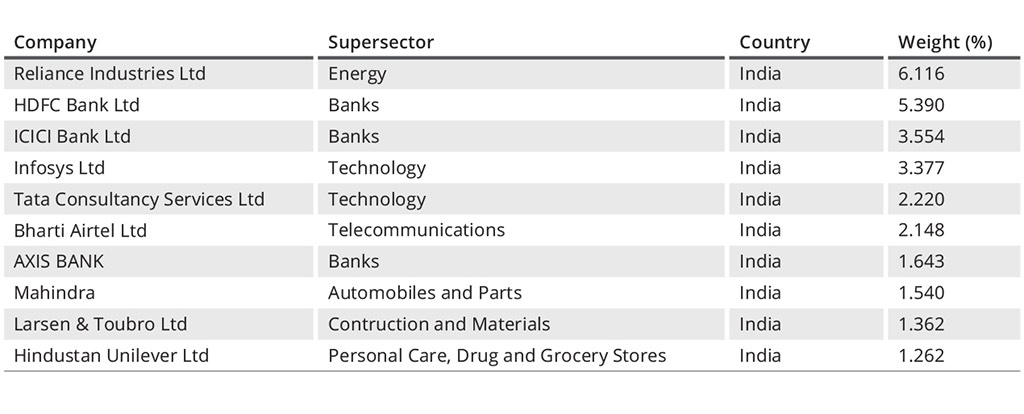

Figure 3 shows the index’s largest components as of July 15, 2024.

Figure 3: Top 10 index components

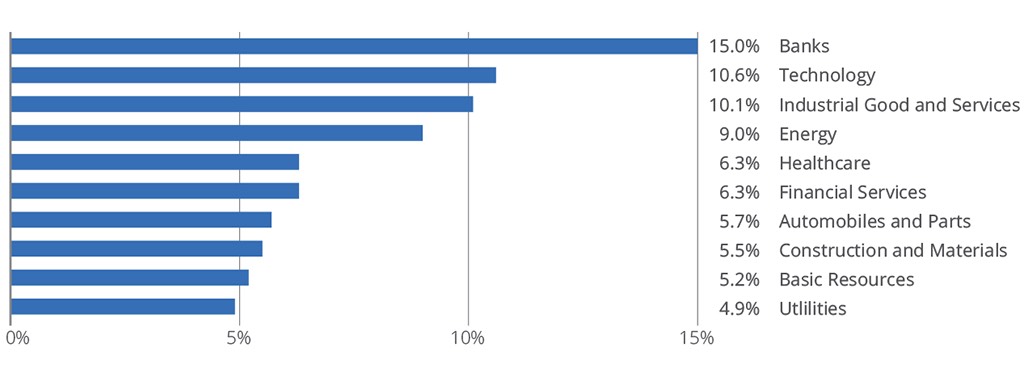

Figure 4 displays the index’s Supersectors distribution. Banks, Technology and Industrial Goods & Services all surpass a 10% weight threshold. Overall, the Supersector distribution shows a highly diversified index.

Figure 4: Supersector weightings

Asia’s growth story

With a population of 1.4 billion, a rising middle class and an increasingly important position as a global services and products provider, India has been a stellar story among emerging markets in recent years. The performance of Indian companies may suggest that investors believe the country has picked up the baton from China as Asia’s powerhouse.

[1] USD gross returns, data through July 15. Source: STOXX.

[2] Source: World Bank, GDP in current USD.

[3] IMF, “World Economic Outlook,” July 2024.