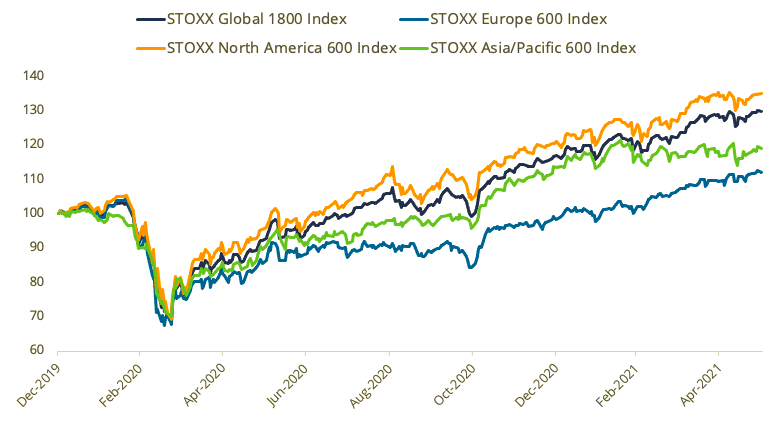

Stocks rose for a fourth consecutive month in May, with the STOXX® Global 1800 Index extending its all-time high, as countries lifted restrictions put in place to control the COVID-19 pandemic.

The global index gained 1.5% during the month when measured in dollars and including dividends.1 The index dropped 0.1% in euros as the greenback weakened 1.6% against the common currency.

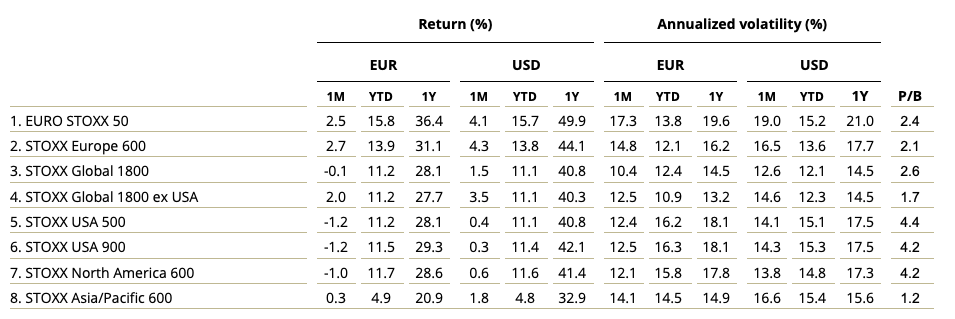

The pan-European STOXX® Europe 600 Index increased 2.7% in euros during the month and also marked a new record high when excluding dividends.2 The Eurozone’s EURO STOXX 50® Index climbed 2.5% and remained at its highest level since January 2008 on a price basis. The STOXX® North America 600 Index rose 0.6% in dollars, held back by consumer-related, utility and technology stocks. The STOXX® Asia/Pacific 600 Index increased 1.8% in dollars.

The STOXX Global 1800 rose 16.9% last year, its second straight year of double-digit percentage gains, as investors raised expectations that policy support and vaccines will help economies overcome the pandemic-induced slump. The index has gained a further 11.1% in 2021.

Figure 1 – Returns since Jan. 1, 2020

Figure 2 – Benchmark indices’ May risk and return characteristics

| For a complete review of all indices’ performance last month, visit our May index newsletter. |

Volatility ticks higher

The EURO STOXX 50® Volatility (VSTOXX®) Index, which tracks EURO STOXX 50 options prices, fell to 19.1 at the end of last month from 20.6 in April. A higher reading suggests investors are paying up for puts that offer insurance against stock price drops.

Gains for developed markets

All but one — Singapore — of 25 developed markets tracked by STOXX advanced during May when measured in dollars. The STOXX® Developed Markets 2400 Index climbed 1.4% in dollars but slipped 0.2% in euro terms.

Fifteen of the 21 national developing markets also posted a gain for the month. The STOXX® Emerging Markets 1500 Index rose 3.8% in dollars and 2.2% in euros.

Banks on top

All but five of 20 Supersectors in the STOXX Global 1800 climbed in the month. The STOXX® Global 1800 Banks Index (+6.2%)3 led gains. The STOXX® Global 1800 Retail Index came last with a 3% decline, after topping all other sectors in April.

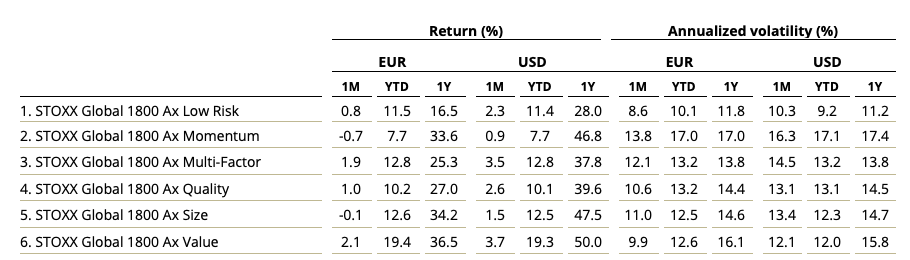

Value factor back in favor

After pausing in April, investors resumed their move towards Value stocks in May, according to the STOXX Factor Indices tracking global portfolios. The STOXX® Global 1800 Ax Value Index rose 3.7% in dollars in May for a 2021 advance of 19.3%.

The STOXX® Global 1800 Ax Momentum Index, the index family’s laggard in terms of 2021 returns, came last in May with a 0.9% gain.

The STOXX® Global 1800 ESG-X Ax Value Index, which applies the same factor approach but also excludes companies involved in controversial activities from a sustainability point of view, rose 3.4% in May.

Figure 3 – STOXX Factor (Global) indices’ May risk and return characteristics

On a regional basis, gains were led by the STOXX® Europe 600 Ax Value Index (+5.3%), STOXX® USA 900 Ax Value Index (+2%) and STOXX® Asia/Pacific 600 Ax Low Risk Index (+1.4%).

New sustainability indices

May saw the second month of trading for STOXX’s new sustainability index families, many of which had strong relative returns.

These include the STOXX ESG Broad Market Indices, which apply a set of compliance, product involvement and ESG performance exclusionary screens on a starting benchmark universe until only the 80% top ESG-rated constituents remain. Companies that are non-compliant based on the Sustainalytics Global Standards Screening assessment or are involved in controversial weapons are not eligible for selection. Additional filters exclude companies involved in tobacco production, thermal coal and military contracting.

The STOXX® Global 1800 ESG Broad Market Index returned 34 basis points more than the benchmark STOXX Global 1800 during May. The EURO STOXX® ESG Broad Market Index, meanwhile, beat the benchmark EURO STOXX® Index by 40 basis points.

Next, the STOXX and DAX ESG Target Indices seek to significantly improve the benchmark portfolio’s ESG profile, while mirroring its returns as closely as possible. The indices follow a similar initial selection methodology as the STOXX ESG Broad Market Indices. From that selection pool they implement, through a series of constraints, an optimization process to maximize the overall ESG score of the portfolio while constraining the tracking error to the benchmark.

The STOXX® Global 1800 ESG Target Index added 1.9% and the EURO STOXX® ESG Target Index rose 3.2%. The DAX® ESG Target Index increased 1.4%.

The STOXX ESG TE Indices, meanwhile, follow a similar methodology to the ESG Target Indices, but the optimization imposes a tracking error minimization, subject to a constraint of improving the ESG score of the resulting portfolio. The EURO STOXX® ESG Target TE Index added 2.9% last month.

Finally, the STOXX SRI indices apply a rigorous set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

In the month that ended, the SRI indices produced returns that topped those of benchmarks. The EURO STOXX® SRI Index (+3.2%), for example, returned 58 basis points more than the EURO STOXX® Index.

ESG-X and ESG integration indices

The new ESG indices add to an existing universe of solutions that has given investors options to pursue ESG exclusion and integration strategies. Among them, the STOXX® ESG-X indices performed broadly in line with their respective benchmarks during May. The indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions of leading asset owners.

Within indices that combine exclusions and ESG integration, the EURO STOXX 50® ESG Index (+2.8%) beat its benchmark by 26 basis points in May. The ESG index, which is derived from the iconic EURO STOXX 50 Index, outperformed by more than 3 percentage points in 2020.

The DAX® 50 ESG Index, which excludes companies involved in controversial activities from a sustainability point of view and integrates ESG scoring into stock selection, rose 2.3% and outperformed the benchmark DAX.

Climate benchmarks

There were strong performances from the STOXX Paris-Aligned Benchmark Indices (PABs) covering the European market. The STOXX Climate Transition Benchmark Indices (CTBs) also did better than benchmarks. The indices were introduced last year and follow the requirements outlined by the European Commission’s Technical Expert Group (TEG) on climate benchmarks.

Among the STOXX Low Carbon Indices, the EURO STOXX 50® Low Carbon Index (+2.8%) topped its benchmark by 28 basis points in the month that ended.

Thematic investing lags behind

The STOXX® Thematic Indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven. Fifteen of 22 revenue-based thematic indices underperformed the STOXX Global 1800 Index during May.

The STOXX® Global Electric Vehicles & Driving Technology Index rebounded from April’s bottom slot to top of the rank last month, after gaining 5.5%. The STOXX® Global Sharing Economy Index came out last, losing 3.6%.

Among the three STOXX artificial-intelligence-driven thematic indices, the iSTOXX® Yewno Developed Markets Blockchain Index (+2.3%) beat the benchmark STOXX Global 1800 for a fourth consecutive month.

Dividend strategies

The dividend strategies tracked by STOXX, which had a bumper first quarter, extended their strong relative performances last month. Some dividend indices rose twice as much as benchmark Global 1800 Index.

The STOXX® Global Maximum Dividend 40 Index (+3.2%) selects only the highest-dividend-yielding stocks. The STOXX® Global Select Dividend 100 Index (+3.4%), meanwhile, tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments, while the STOXX® Global Select 100 EUR Index (+0.6%) blends increasing dividend yields with low volatility.

Finally, the STOXX® Global ESG-X Select Dividend 100 Index (+3.4%) belongs to the STOXX ESG-X Select Dividend family. The suite was introduced in February and targets the highest-yielding stocks within universes screened for responsible investment criteria.

Minimum variance

There were strong performances in May from minimum variance strategies covering the US market. The STOXX® USA 900 MV Unconstrained Index added 1.7%. In Europe, the STOXX® Minimum Variance Indices underperformed slightly. The STOXX® Europe 600 Minimum Variance Index added 2.6% in euros, while its unconstrained version increased 2.4%.

The STOXX Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

1 All results are total returns before taxes unless specified.

2 Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in dollars.

3 Figures in parentheses denote May’s gross returns.