Domestic investors are lifting the Chinese equity market to world-beating levels this year, leaving behind concerns about the COVID-19 pandemic and political tensions between China and its trading partners.

The broad STOXX® China A Total Market Index, which tracks companies that are incorporated and operate in the People’s Republic of China (mainland), has gained 18% in 2020 — with a 15% jump in the first two weeks of July.1 The benchmark STOXX® China A 900 Index has risen at the same rate.

China’s A shares make up the country’s biggest market and are traded in renminbi on the Shanghai and Shenzhen stock exchanges. The market is dominated by retail investors, although international investors can access it under special arrangements such as the Stock Connect program.

The performance represents a sentiment turnaround for investors in the first country to be hit this year by the novel coronavirus. According to Jean-Baptiste Berthon, Senior Strategist for Cross Asset Research at Lyxor Asset Management, a successful containment of the COVID-19 pandemic, a rebound in economic indicators, better-than-expected corporate profits and government stimulus are all converging to underpin a bullish domestic investor base.2

China reported on Jul. 16 that the economy expanded at a 3.2% annual rate in the second quarter — skirting a recession — after contracting 6.8% in the three months to March. The pace of growth significantly surpassed economists’ forecasts and makes China the first major economy to emerge from the COVID-19-induced activity slump.

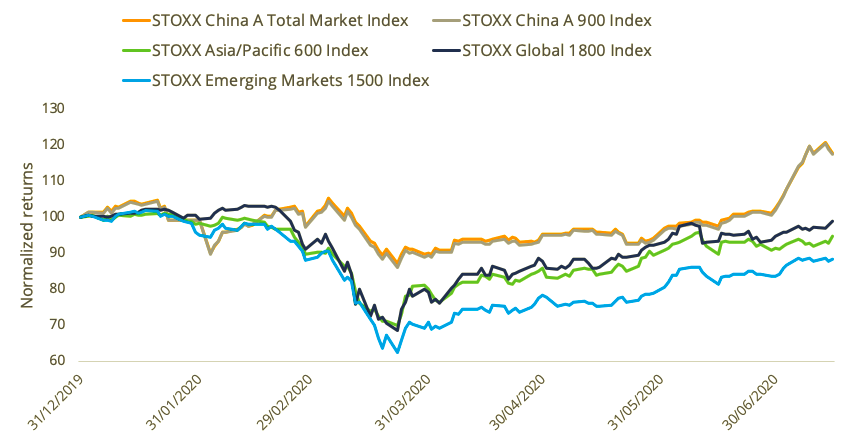

Figure 1 shows that Chinese onshore shares erased all losses for the year in June and have ticked higher in July. STOXX indices covering global, Asia/Pacific and emerging markets are all posting losses for 2020.

Source: Qontigo. All performances are gross in dollars through July 15

The retail-oriented nature of the A-share market gives it a profile of its own and has in the past made it susceptible to bouts of volatility.

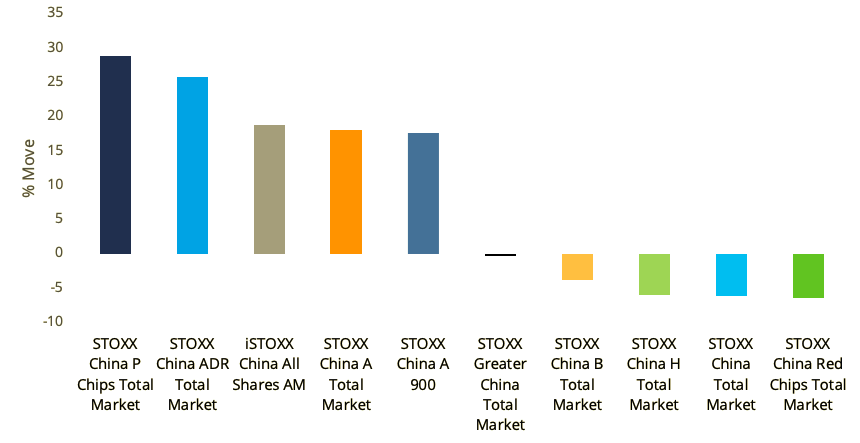

The STOXX® China B Total Market Index, which tracks companies that are incorporated and operate in mainland China and whose stocks are quoted in foreign currencies in Shanghai and Shenzhen, is down 3.8% in 2020. That is worse than the STOXX® Global 1800 Index’s 1% loss, but better than the STOXX® Emerging Markets 1500 Index’s 11.8% retreat. The B-share market is, however, small.

Hong-Kong listed stocks, ADRs

While onshore investors have appeared bullish, offshore markets that offer exposure to Chinese companies show a more diverse performance.

The STOXX® China H Total Market Index (Hong Kong-listed companies that are incorporated and operate in mainland China), is down 6% this year. Similarly, the STOXX® China Red Chips Total Market Index (Hong Kong-listed companies that are incorporated outside of, but operate in, mainland China) has lost 6.5%.

On the other hand, the STOXX® China ADR Total Market Index has jumped 25.8%. The index tracks American depositary receipts (ADRs) of companies that are not incorporated in mainland China but derive the majority of their revenues from the country. The STOXX® China P Chips Total Market Index has added 28%. The index tracks companies listed on the Hong Kong Stock Exchange, and are incorporated outside of, but derive the majority of revenues from, mainland China.

The iSTOXX® China All Shares AM Index has surged 18.8% in 2020. AM stands for Accessible Market, as the index combines shares that are available to international investors: B, H, Red Chips, ADRs, P Chips plus A shares trading through the Stock Connect program.

Source: Qontigo. All performances are gross in dollars through July 15

It is unsurprising that the indices show such a wide range of performances. Each gauge reflects specific and dissimilar company structures and characteristics, revenue source, economic and corporate regulation, market access and currency.

Overweight position

For investors watching China’s A shares, one of the world’s largest equity markets, Societe Generale SA’s strategists say that valuations are not stretched. With a background of economic growth and low investors’ leverage, they see room for further price gains.

“We maintain our strategic overweight position on China equities based on our expectations of a V-shaped recovery, a targeted fiscal easing, and resilient earnings,” Frank Benzimra, Head of Asia Equity Strategy at the French bank, and Kiyong Seong, Asia Rates Strategist, wrote in a report on July 9. “On that basis it is too early to call the peak in our view.”

1 All performances are gross returns in dollars through Jul. 15, 2020.

2 ‘How are active managers navigating Chinese markets euphoria?’ Lyxor Asset Management, Jul. 15, 2020.

3 STOXX® Greater China Index covers 95% of the entire China B, H, Red Chips, Hong Kong and Taiwan markets.

4 The STOXX® China Total Market Index covers 95% of all China B, H and Red Chips markets.