With struggling economies and falling interest rates, European bank stocks were unlikely winners in 2024.

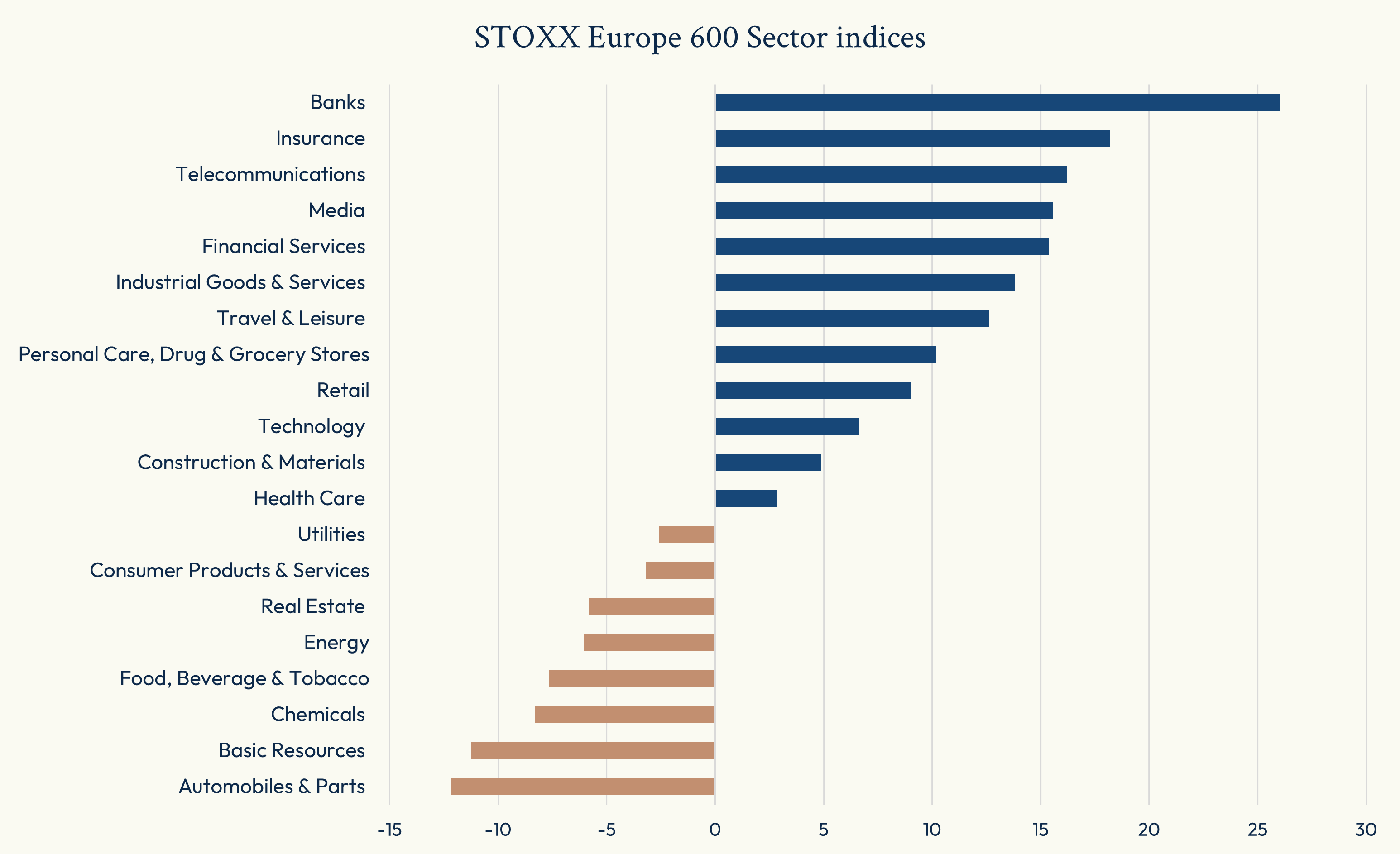

The STOXX® Europe 600 Banks index climbed 26% last year[1], its best performance since the 34% logged in 2021. Only one other year since data going back to 1999 was better: the 47% jump registered in 2009 as the industry bounced back from the global financial crisis meltdown. None of the other 19 ICB Supersectors did as well last year (Figure 1).

Figure 1: 2024 performance

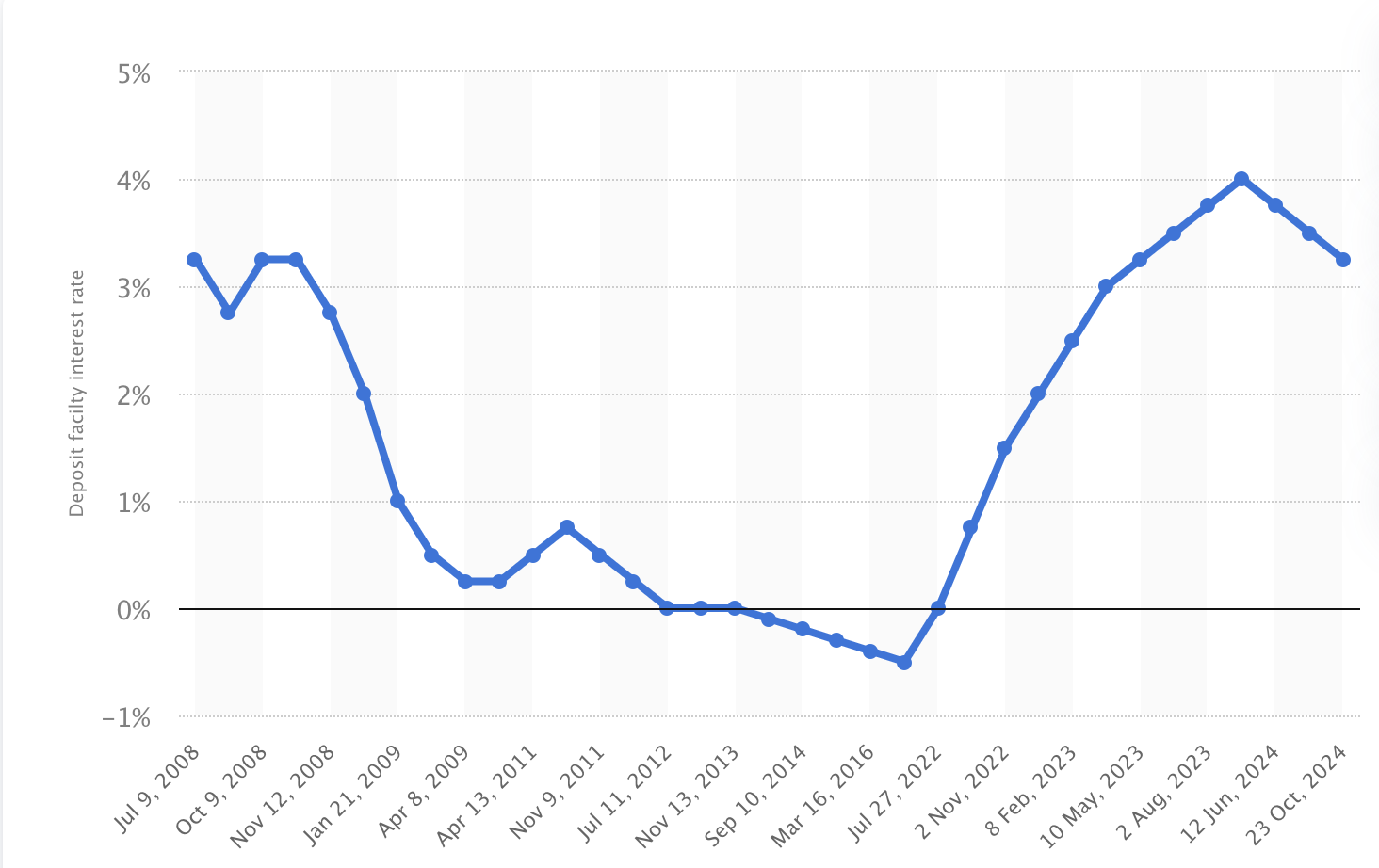

Europe’s banking sector has been helped by high capital ratios and stronger earnings as lenders cut costs and benefit from diversified businesses and high interest rates (Figure 2). Expectations of consolidation in the industry also underpinned share prices in 2024.

Figure 2: Eurozone’s key interest rate

Liquid derivatives

Due to its cyclicality and sensitivity to markets and the economy, the banking sector has traditionally been key in European portfolios. Futures on banking sector indices are the most popular sector derivatives listed on Eurex. Over 2 million futures tracking the STOXX Europe 600 Banks index traded last year, while 55 million futures on the EURO STOXX® Banks index exchanged hands.

Value sector

While the banking sector in Europe lags behind others in terms of earnings growth, investors can nonetheless tap those profits at lower relative prices, following years of underperformance. The STOXX Europe 600 Banks index has the second-lowest price-to-earnings ratio among the 20 STOXX Europe 600 sector indices.[2] The Banks index has the highest dividend yield: its 8.7% payout compares with the average 3.2% for all 20 sector indices.[3]

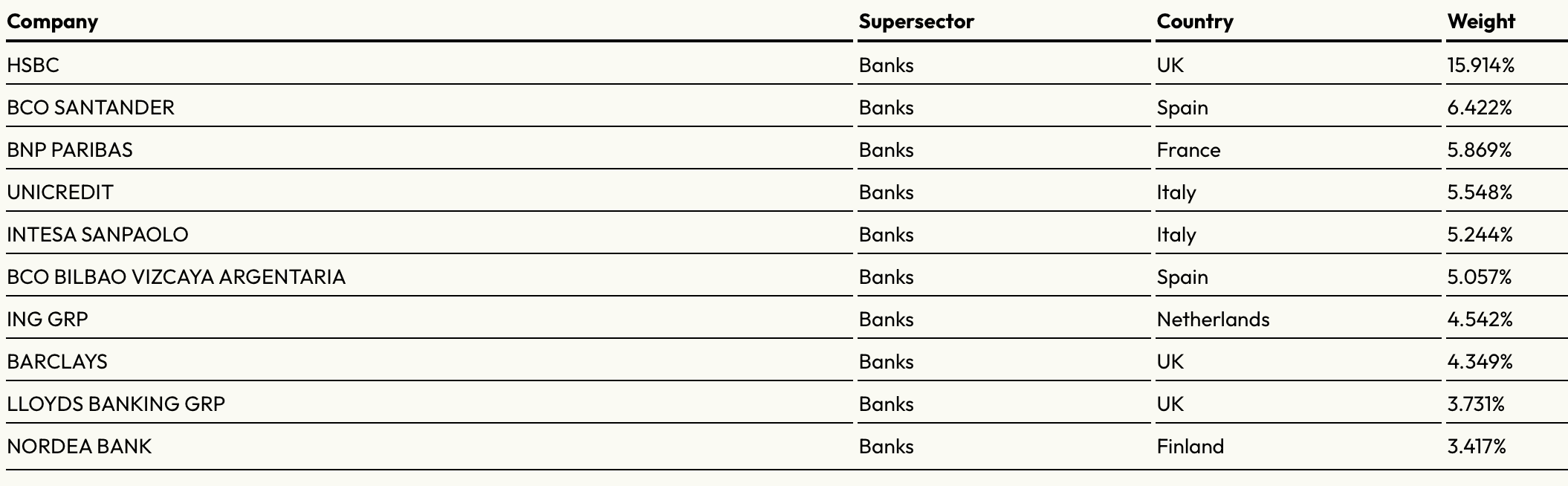

Figure 3 shows the largest components in the STOXX Europe 600 Banks index.

Figure 3: STOXX Europe 600 Banks index holdings

As always, every new year brings reasons to be cautious about the market outlook, and that is true for banks’ stocks in 2025. Among potential headwinds is a decline in interest rates in the Eurozone and the UK, which erodes the net interest margin, or profitability, of banks. An extension of the economic malaise in the region or a jump in sovereign bond yields (as it happened with French bonds throughout 2024) could lift Europe’s financial risk, prompting global investors to choose other regions. Those risks will be ever more present in early 2025, when Germans will vote in federal elections and as France’s minority government tries to lower the nation’s budget deficit.

[1] Price return in euros.

[2] Source: STOXX.

[3] Source: STOXX. Data as of November 29, 2024.