In August 2023, Eurex introduced daily expiring options on the EURO STOXX 50® index (OEXP), giving participants targeted market exposure to react quickly and precisely to specific events.

More than 360,000 EURO STOXX 50 daily options contracts have traded on average per month since launch.[1] In November last year, daily options were introduced on Germany’s blue-chip index DAX® (ODAP).

As the daily options segment gains liquidity, its activity provides insights into risks priced in the market, measured by the implied volatility, around macroeconomic news.

We sat down with Patrick Bonouvrie, Head of Index Derivatives for Europe at market maker Optiver, a leading liquidity provider in EURO STOXX 50 daily options; and with Dorte Carlsen, Equity and Index Sales for EMEA at Eurex, and Sahand Taghizadeh, Director for Global Investable Benchmarks at STOXX. We asked all three what the introduction of equity index daily options means for the market and participants.

Patrick, what do daily options bring to the European market? Can you elaborate on what type of investors are active in the segment and what their typical use cases are?

“Over the past year we’ve seen multiple European exchanges launch daily-expiring options. Some have gained traction faster than others and we expect adoption to grow, albeit not at the pace that we’ve seen in the US. What is encouraging to see is that daily options are making a positive impact on the overall liquidity picture, and volumes traded in daily expiries aren’t coming at the expense of longer-term expiries.

We’ve seen all types of institutional counterparties as well as retail investors active in this product. Blocks are generally traded at a similar width to weekly options, and we have traded blocks around 7,500 contracts. There is quite a bit of flow around US data releases that occur during European hours, like the Consumer Price Index and Non-farm Payroll numbers, so traders are using the options to position around these events. Gamma hedging and hedging weekend exposures, especially around geopolitical events, are also popular use cases among institutional counterparties.”

Dorte, in the US, the retail segment played an important role in building up liquidity in daily options. How have retail investors in Europe received the product? And can we expect to see a shift in liquidity towards the shorter expiries, similar to what happened in the US?

“Retail engagement in listed derivatives in Europe has traditionally been lower than in the US. However, the response to daily options has been positive, with key retail brokers across Europe being active in the product and retail volumes going up. Furthermore, we are receiving huge demand from retail brokers for educational content on daily options, indicating strong interest from this segment and suggesting potential for increased engagement over time.

It is still early days for the product in Europe. So far, liquidity in longer-dated expiries surpasses liquidity in the daily options and we don’t think the large development in short-dated options observed in the US is likely to be replicated in Europe. Nevertheless, we believe the product has significant growth potential.”

Patrick, options can provide insight into risks priced in the market. Can you cite any example where EURO STOXX 50 daily options show traders are taking a position with regards to a given event?

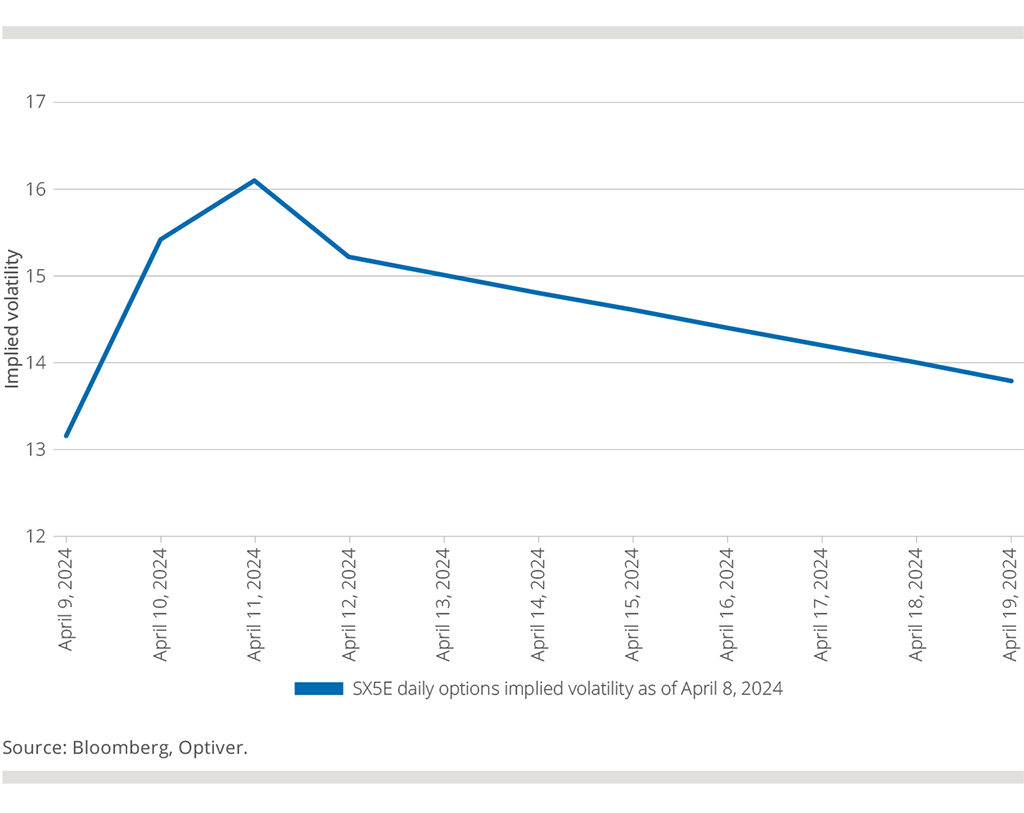

“Since launch, the daily options have become increasingly liquid and are now quoted tighter than the weekly options. A good example of investors using this product to position for events comes from looking at EURO STOXX 50 implied volatility as of April 8. On April 10, US Consumer Price Index data for the month of March was due, and the next day the European Central Bank was scheduled to issue its latest policy decision. Both of these events contributed to a steepening of the volatility curve, with dailies’ implied volatility trending higher over that period.”

Figure 1: Options’ implied volatility

Sahand, why is the EURO STOXX 50 a popular instrument to trade the risk around economic events in the Eurozone?

“The EURO STOXX 50 index has an entire ecosystem of financial products that creates deep liquidity in the index and its constituents. There are various factors why the EURO STOXX 50 is such a popular instrument: the index is strictly rules-based, it contains the largest companies in each Supersector, and selected securities have deep liquidity and great market coverage. Moreover, a vast menu of listed derivatives and structured products around the index enhances the liquidity aspect of its ecosystem, and give each investor the possibility to trade their specific view. Finally, there is substantial AuM in the passive investment world tied to the EURO STOXX 50. All of this makes it a highly regarded, well-watched barometer of the Eurozone market.”

Dorte, how do daily options fit in with Eurex’s product offering and strategy?

“Daily options are a natural extension of our product offering, enabling investors to accurately hedge and position themselves for specific events and utilize risk premia and relative value in the short end of the curve. The product will furthermore support our effort to attract new investors and help to improve liquidity in our benchmark options. The launch of daily options on the DAX index shows our commitment to the product segment.”

Finally, Sahand, how do daily options enhance the product ecosystem around the EURO STOXX 50 and DAX indices?

“Daily options expand the toolbox for investors. As Dorte and Patrick have mentioned, they may help to hedge remaining risks in a portfolio or to place a specific strategy more precisely, to name a few use cases. That attracts more investors to trade the index, and consequently enhances the entire product ecosystem.”

[1] Data through May 2024.