Last November, DWS launched the first ETFs tracking the ISS STOXX® Biodiversity indices, a suite that integrates nature-related risks and opportunities into investment portfolios through a comprehensive approach.

The three new Xtrackers ETFs track, respectively, the following indices:

- ISS STOXX® Developed World Biodiversity Focus SRI

- ISS STOXX® Europe 600 Biodiversity Focus SRI

- ISS STOXX® US Biodiversity Focus SRI

We took the opportunity to get the perspective of the three parties involved in the design of the new products. Below is our exchange with Olivier Souliac, Head of Indexing at Xtrackers by DWS; Hernando Cortina, Head of Index Strategy at ISS ESG, which provides the biodiversity data; and Antonio Celeste, Director for Sustainable Product Management at STOXX.

Olivier, what was the driver behind the launch of the Biodiversity Focus SRI ETFs?

Olivier (Xtrackers): “There was not one but several drivers behind this project. The first one is local regulations and multilateral initiatives. There is a strong push from regulators to measure the impact on biodiversity of an investment, something that has been complemented by a number of initiatives such as the Science-Based Targets for Nature (SBTN) and the Taskforce on Nature-related Financial Disclosures (TNFD). Setting up the methodologies and the normative framework to understand, quantify and report the nature-related impact of an investment and of companies has enabled us to tackle the issue of biodiversity investing. Only then could we consider launching a product: only when you know how to measure, will you know how to improve.

A second driver has been the availability of an index-based response. What persuaded us to launch ETFs is that not only do we now have a framework but also an application of that framework — in the form of indices — based on credible datasets and a credible methodology.

The last factor is emerging demand for investments that address the financial materiality that comes with the loss of biodiversity. The sustainability offices of large investors such as asset owners have identified biodiversity risk as one of the next challenges that they want to address at a firm level in the near future.”

What are some of those risks for investors associated with biodiversity loss?

Antonio (STOXX): “Biodiversity loss has emerged as a key source of risk for investors and companies. The move to protect our habitats raises the regulatory liabilities for corporates and investors (for example, increasing legislation such as the banning of pesticides). This comes at a time when they are already facing biodiversity-related physical, transition and systemic risks. Physical risks include the loss of raw materials and the disruption of operating environments. Transition risks cover policy shifts, changes in market preferences and voluntary commitments. Systemic risks include the increased odds and breadth of global pandemics derived from ecosystem change.

Looking at the flip side, there are opportunities as well. Some companies are managing their supply chain and operations, and creating products and services with a positive impact on biodiversity.”

Antonio, can you describe the concept and process behind the ISS STOXX Biodiversity indices?

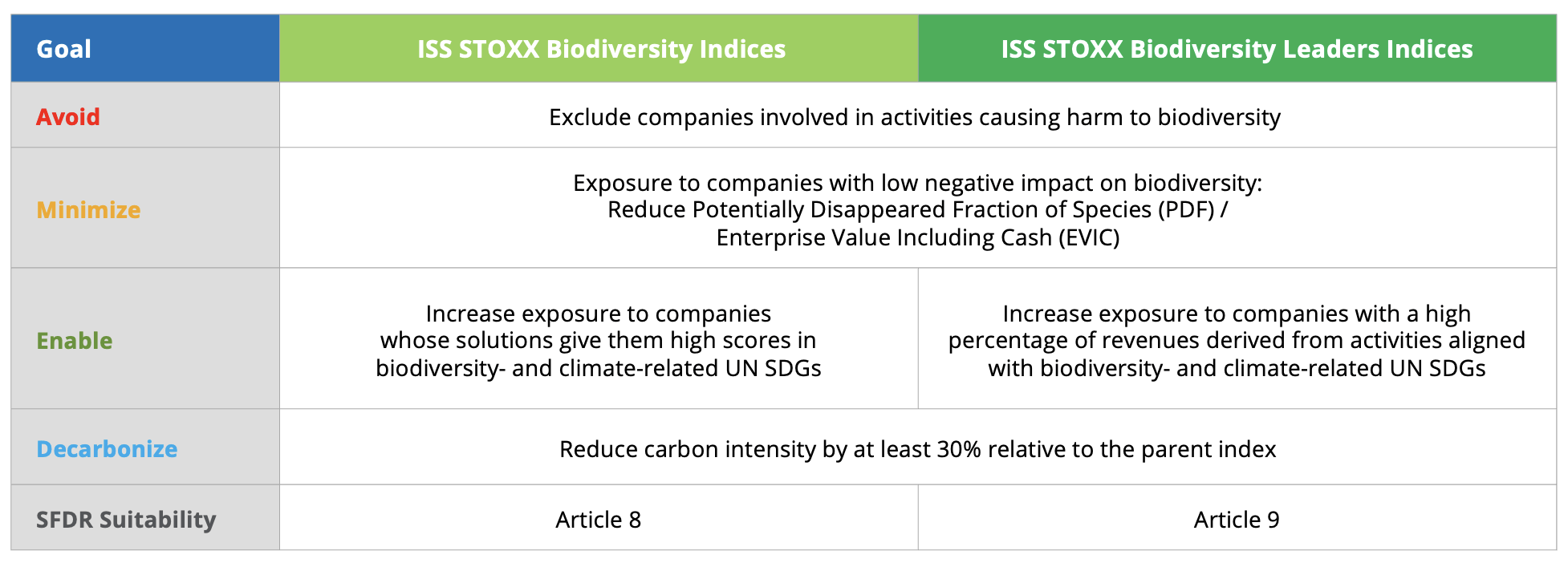

Antonio (STOXX): “The ISS STOXX Biodiversity framework has been designed as a holistic approach for investors to tackle those risks and opportunities described earlier. The ISS STOXX Biodiversity indices employ that framework and follow a multi-step process that approaches biodiversity through three different angles: Avoid (excluding companies that cause harm to biodiversity), Minimize (removing companies with the most negative biodiversity footprint), and Enable (tilting towards companies whose products and services aid biodiversity-related goals). An additional layer reduces the portfolio’s carbon footprint.

The framework can be applied to match investors’ specific preferences, integrating its steps and data on existing indices and strategies. For example, you can have a Paris-aligned benchmark and add a biodiversity layer on top of it.

Our off-the-shelf offering includes two categories of ISS STOXX Biodiversity indices: the standard and the ‘Leaders’ indices. The latter have a more ambitious threshold in terms of exposure to biodiversity-related Sustainable Development Goals (SDGs), and select Sustainable Investment (SI) companies to ensure compliance with SFDR Article 9. But clients can customize their own products within our framework, as has been the case with DWS.”

Figure 1 – ISS STOXX Biodiversity indices framework

Why is it important to have different steps or layers to come up with a comprehensive biodiversity impact investment strategy?

Olivier (Xtrackers): “We think of this range as being a logical continuation of the core ESG ETFs that have come to market in recent years. It remains indeed focused on integrating sustainability risks. When you tackle biodiversity, you may want to integrate it within your existing sustainability agenda. In this sense, there are three key considerations related to biodiversity that Antonio already touched upon: the first one is the incorporation of Socially Responsible Investment-related exclusions (also integrating activities that are established to be controversial with regards to biodiversity, or “avoid”). The second factor that needs to be taken into account, and it is probably the most challenging, is the qualitative measurement of a company’s biodiversity impact. This is where the heart of the strategy lies. Here, adopting a traditional best-in-class strategy makes sense: just as you have low-carbon indices, you can obtain a lower biodiversity risk impact approach, where you don’t change the breadth and depth of the investment and you maintain the diversification and representativeness in terms of industry exposure.

The last point touches upon company operations and revenues. Which is, to what extent the activity of a company supports certain SDGs linked to biodiversity. Here, removing worst-in-class companies adds a forward-looking element to the overall approach (the ‘Enable’ part).”

Hernando, advancements in biodiversity data in recent years have been key to the design of the ISS STOXX Biodiversity framework. Where are we in the evolution of these datasets?

Hernando (ISS ESG): “ISS ESG has invested heavily in biodiversity data over the last couple of years, driven by both regulatory changes as well as underlying investor demand. Over this period, we have indeed seen a major evolution with more advanced and refined data.

The focus of the data has evolved as well. The central element now lies in tying a corporation to its biodiversity impact, whereas before there was a more general focus on the products that a company makes or simply where it is located. We can now quantify more precisely the metrics that biologists and scientists have developed.

The two most common metrics are the Potentially Disappeared Fraction of Species (PDF) and the Mean Species Abundance (MSA), both part of ISS ESG’s Biodiversity Impact Assessment Tool (BIAT). PDF quantifies the potential loss of species richness due to adverse environmental pressures, relative to species richness in undisturbed ecosystems. MSA quantifies the mean abundance of original species relative to that in undisturbed ecosystems. We are the only provider that currently delivers both PDF and MSA.

We also have another subset of data within BIAT called Ecosystem Services. It allows us to know how dependent a company is on biodiversity to generate its products and services.

That said, as an industry we are still at a relatively early stage in the biodiversity analytics process. Companies have only started to understand what they need to report. Currently, the data is all modelled. Over time, we hope to get more comparable data directly from companies. TNFD should be a significant accelerator of this process.”

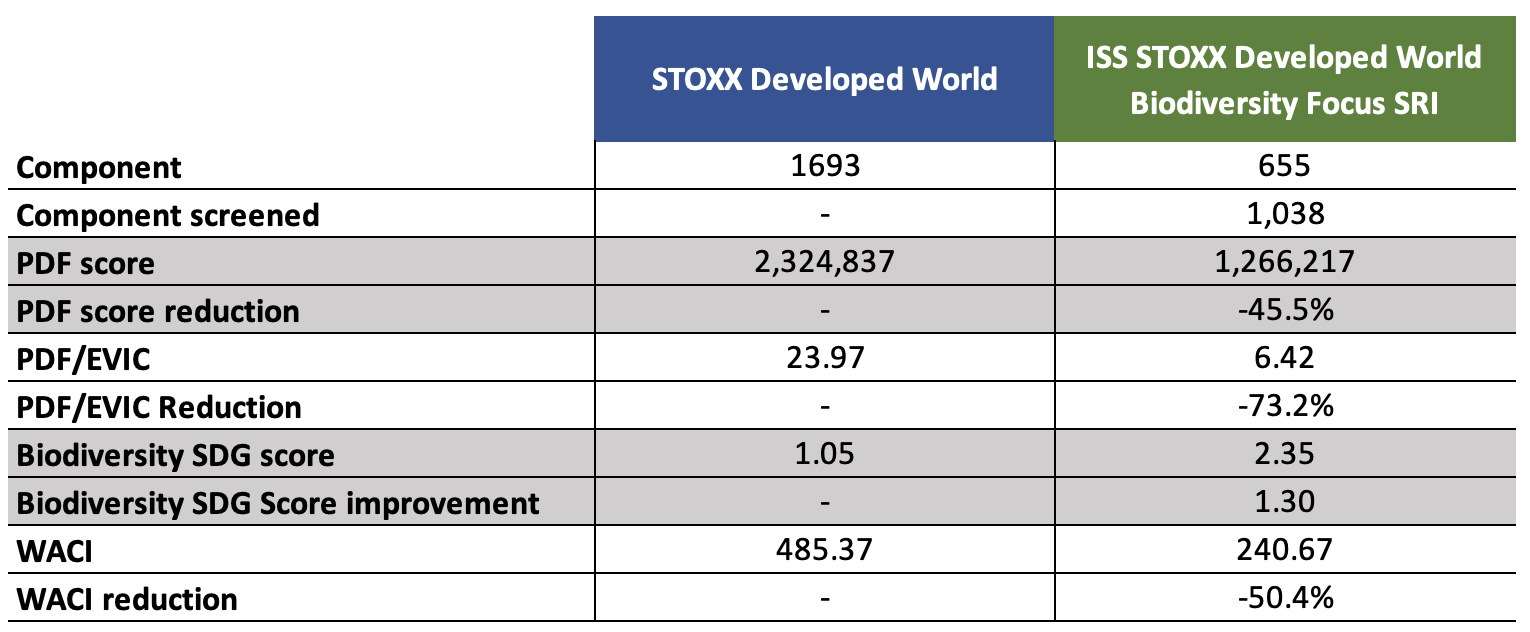

What are some results of integrating such datasets at a portfolio level, relative to a benchmark?

Hernando (ISS ESG): “Depending on the index, we can achieve reductions between 25% and 90% in overall PDF and a reduction of between 25% and 75% in PDF intensity. In addition, having a focus on biodiversity delivers side effects that are attractive to investors: for example, the strategy roughly halves the Scope 1 to 3 carbon intensity of the portfolio.”

Figure 2 – ISS STOXX Developed World Biodiversity Focus SRI index results

Where do these ETFs fit in a typical investment allocation?

Olivier (Xtrackers): “These ETFs are part of our toolbox to help investors allocate capital in their core exposures, in compliance with their sustainability agenda. That is why we have three products that cover the core allocations of our institutional investors: Europe, the US and the developed world. We do not see these ETFs as being opportunity- or thematic-driven. On the contrary, they are primarily addressed towards our large institutional clients. As an example, a study we launched with CREATE-Research found that pension funds increasingly see it as their duty to contribute, on behalf of their pensioners, to mitigate the negative effects of past economic development on the environment, climate and biodiversity[1]. In this context, we are looking at a core investment that benefits from global beta but that has reduced metrics with regards to environmental aspects such as carbon emissions and, now, the risk of biodiversity loss.”

Some index constituents do not seem to have a clear biodiversity link. Why have they been selected?

Hernando (ISS ESG): “The indices have been designed to deliver a diversified portfolio, so they exclude the highest-impact companies in every sector. As such, the methodology leaves companies that may not necessarily have a clear positive impact, but nonetheless this approach reduces the overall negative impact for investors and asset owners.

This step of the approach puts more focus on reducing harm than on supporting biodiversity-positive solutions. To address the positive aspect, the indices also include an important SDG overlay, seeking companies that have a positive impact on biodiversity-related SDGs.”

How do the indices correlate with the recently introduced TNFD recommendations?

Antonio (STOXX): “That’s a very timely question. Last year’s TNFD recommendations set a roadmap to guide companies in integrating nature into their governance, strategy, risk and impact management, as well as metrics and targets. Importantly, the framework also supports financial institutions in portfolio construction and investment product development. It follows a broad action sequence (Avoid, Reduce, Restore, Regenerate, Transform) that is correlated to a high degree with the four-step index construction process at the core of the ISS STOXX Biodiversity indices framework (Avoid, Minimize, Enable, Decarbonize). So, to summarize, both STOXX and TNFD frameworks contemplate similar steps addressing the different degrees and types of biodiversity action.”

Finally, Olivier, why did you choose ISS ESG and STOXX as partners in this project?

Olivier (Xtrackers): “We were very pleased to see that ISS ESG and STOXX were able to propose a comprehensive, institutional-grade assessment framework for biodiversity integration. And we were convinced by the quality of the PDF dataset, which had consistent outcomes and was broad enough in its coverage. We are also very familiar with the SDG-related datasets that are already in use in different portfolios at DWS. Biodiversity impact is an incredibly complex topic, and we needed the right expertise to tackle all aspects of it. The combination of STOXX and ISS ESG means you have established benchmarks with leading biodiversity datasets that you can apply as a core investment. This is something that the teams at STOXX and ISS ESG had been working on already, so it was a perfect fit for us. During the project, we also came to appreciate the constructive cooperation in developing our ETFs.”

[1] DWS, “Study by DWS and CREATE-Research shows pension funds growing interest in impact investing,” September 1, 2022.