Eurex will introduce futures on the STOXX® Europe 600 SRI, an index for European equities with product-involvement exclusionary screens as well as filters to remove the highest-emitting companies and include those with the best ESG scores.

The contracts will be listed on Monday, January 22 and follow in the footsteps of the successful adoption of futures on the STOXX® EUROPE 600 ESG-X, which have become some of the world’s most traded ESG derivatives. Since listing in February 2019, more than 7 million contracts have exchanged hands on Eurex, with current open interest sitting at EUR 1.6 billion.[1]

The STOXX SRI indices are part of the ESG & Sustainability family at STOXX, and cover all the major regions. They track the performance of underlying benchmarks after screens are applied for carbon emission intensity, business involvement and ESG performance.

Investors and traders who must comply with responsible policies have turned to sustainability index derivatives to manage portfolio flows and sustainability risks. Futures, in particular, add to a portfolio’s liquidity and help lower trading costs.

“Clients are increasingly seeking derivatives that align with their unique sustainable investment requirements, all while continuing to meet their portfolios’ tactical and management needs,” said Axel Lomholt, General Manager at STOXX. “Together with Eurex we are building a growing ecosystem of trading tools so investors can efficiently meet these objectives and requirements, and integrate their sustainability considerations in a transparent and regulated manner.”

Selection process

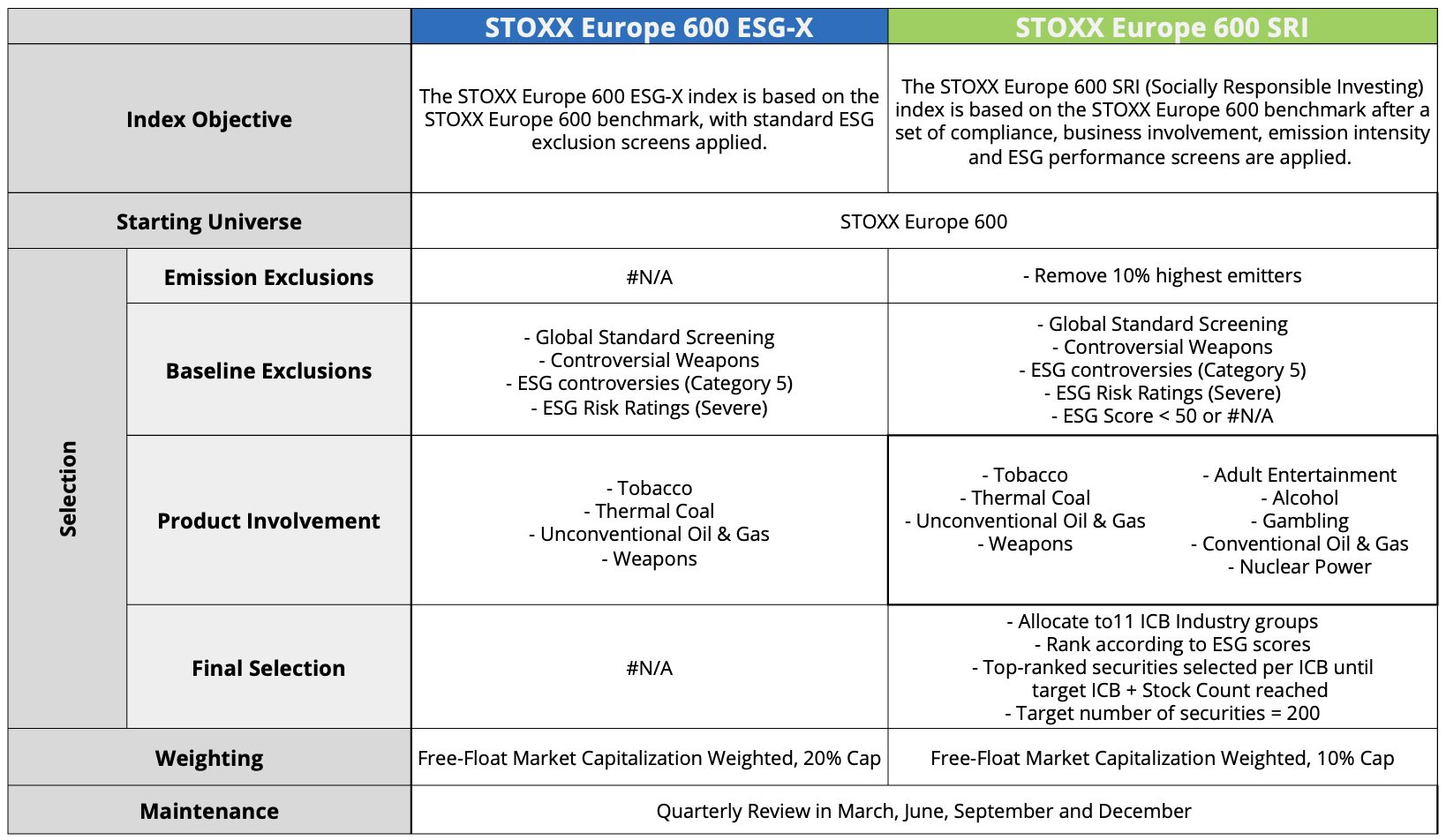

Figure 1 shows all the exclusionary screens applied in the STOXX Europe 600 SRI index, which go beyond those represented by the STOXX Europe 600 ESG-X.

After the screens are applied, the remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industry groups. The STOXX SRI Indices select the top-ranking companies in each of the ICB Industries until the number of selected stocks reaches a third of the number in the starting benchmark.

Figure 1: Methodology comparison between STOXX Europe 600 SRI and STOXX Europe 600 ESG-X

ESG results

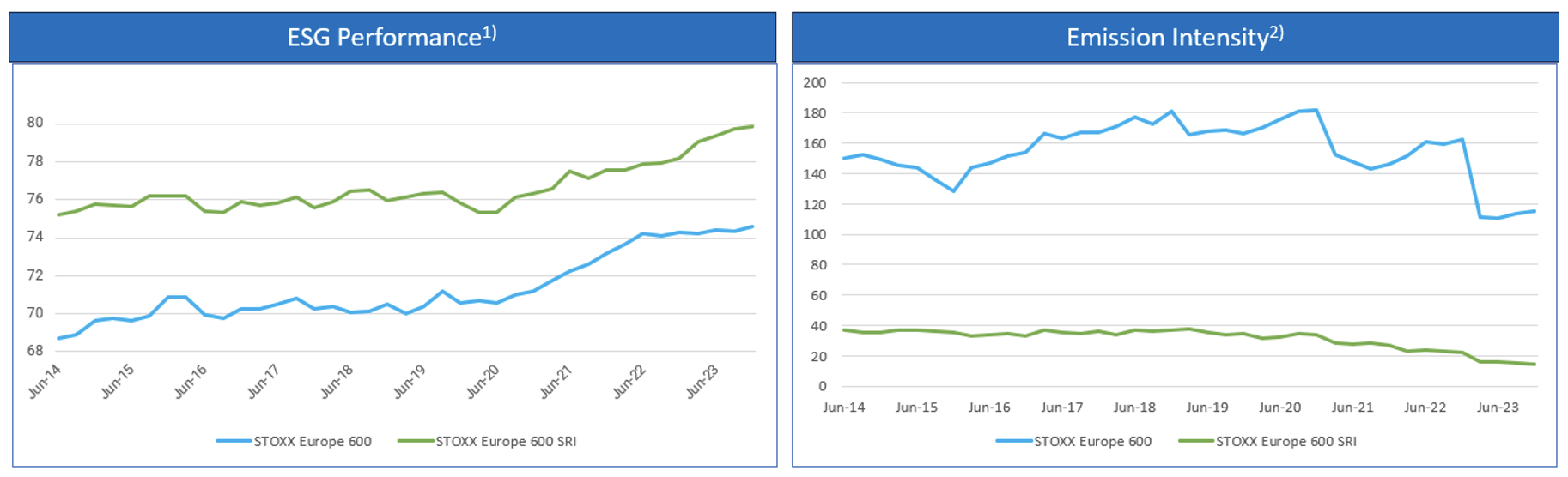

Since 2014, the SRI portfolio has had an average ESG score that is 7.4% higher than that of the benchmark (Fig. 2). As of December 2023, it had lowered the carbon emission intensity by more than 85%.

Figure 2: ESG and carbon emission performance

Comparative metrics

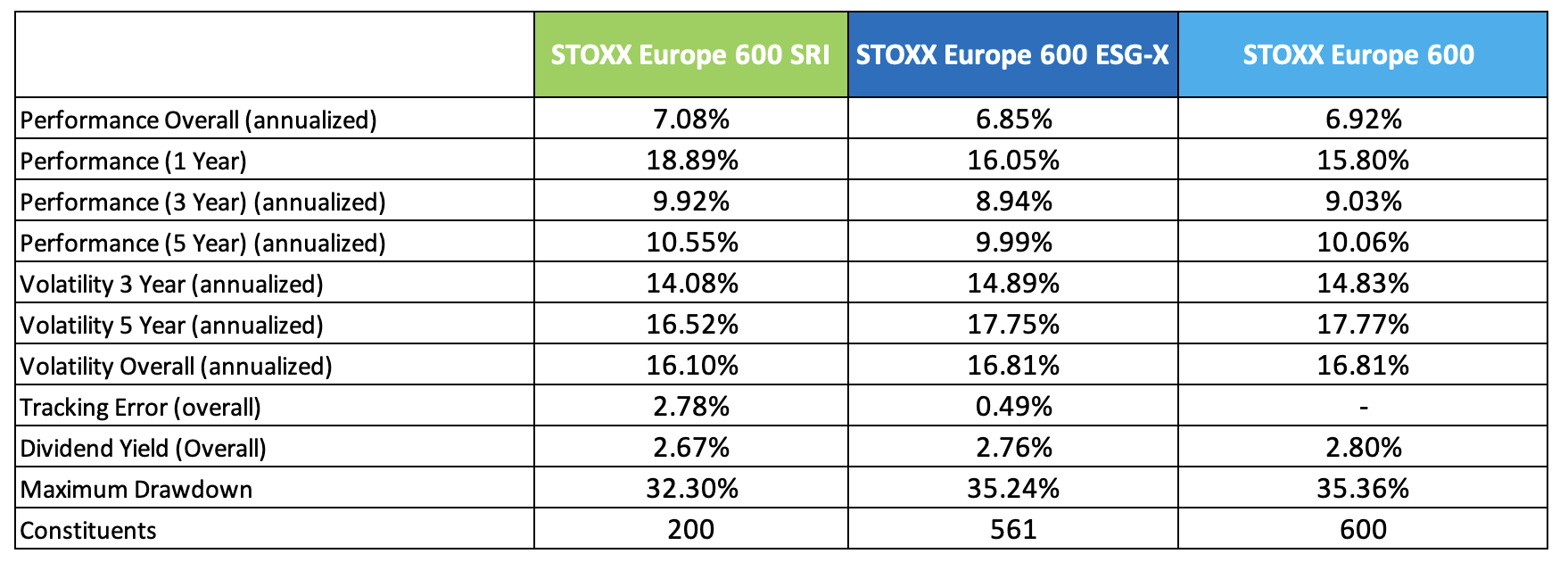

Figure 3 shows risk and returns metrics for the STOXX Europe 600 SRI, the STOXX Europe 600 ESG-X and their benchmark, the STOXX Europe 600.

Figure 3: Risk and return characteristics

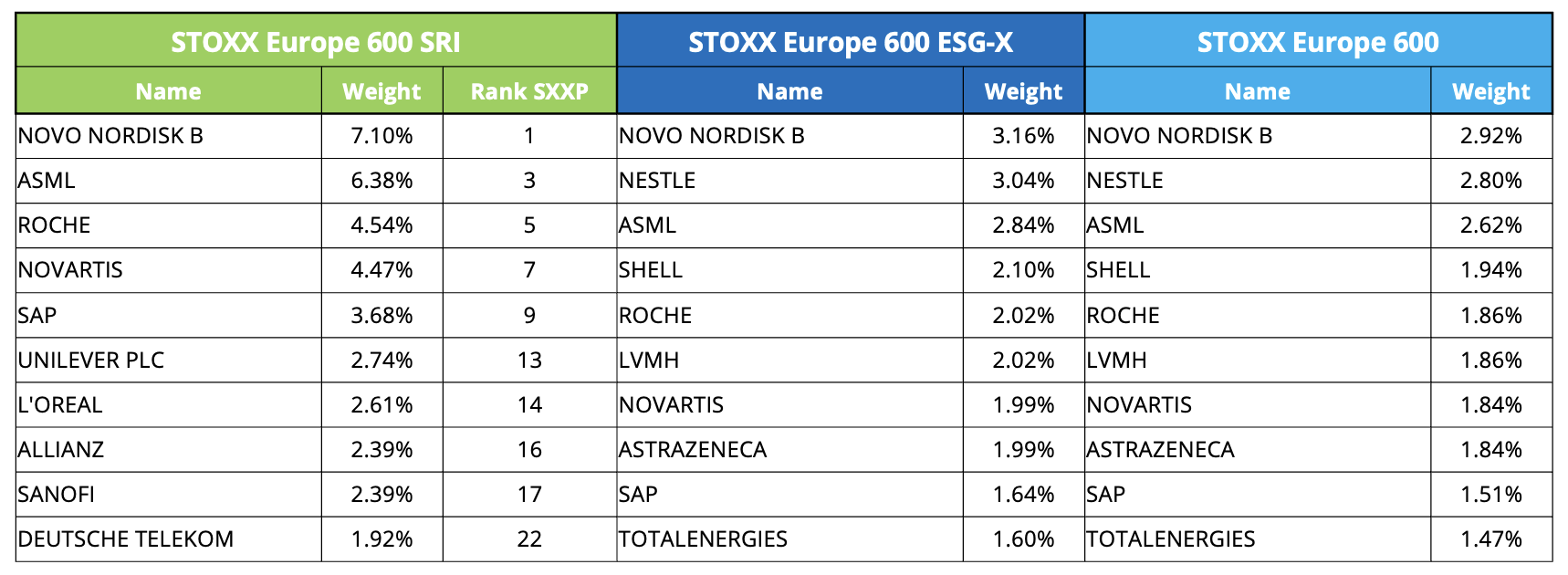

Figure 4 compares the top ten constituents of the benchmark STOXX Europe 600, STOXX Europe ESG-X and STOXX Europe 600 SRI indices.

Figure 4: Top holdings

Ongoing collaboration

The introduction of ESG futures in recent years has enabled ESG investors to efficiently manage their portfolios, and avoid mismatches and breaches in responsible policies. In 2019 Eurex and STOXX launched the first pan-European sustainable futures, with the STOXX Europe 600 ESG-X contracts. The latest roll-out with the STOXX Europe 600 SRI futures deepens that collaboration and gives investors a more targeted option when it comes to responsible investing in the derivatives segment.

[1] Data through December 2023.