The launch of the DAX® Equal Weight Index this month presents a good opportunity to review the virtues of an equal-weight equity strategy.

Looking across different markets and time periods, a portfolio whose holdings have had an equal allocation to them has outperformed the traditional market-capitalization-weighting positioning. The latter strategy has been the core offering since the inception of equity indices and still governs a majority of benchmarked portfolios.

Chart 1 shows the performance of the STOXX® Europe 600 Index and that of its equal-weight version since 1991. The benchmark index has gained 531% over the period, less than the 756% return for the equal-weight index.

Chart 1

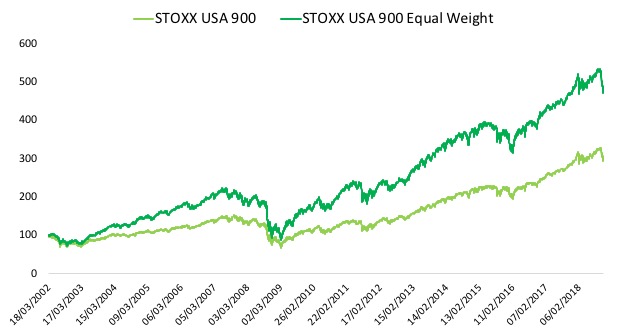

Chart 2 displays a similar analysis on the STOXX® USA 900 Index. The market-cap-weighted benchmark for American equities has returned 181 percentage points less than its equal-weighted variant since 2002.

Chart 2

Source: STOXX, total returns after taxes in USD, Mar. 18, 2002 – Oct. 31, 2018.

From risk management to the size factor

Various studies have put forward several explanations as to why an equal-weight strategy may outperform a market-cap-weighted one.

One of the first arguments is that spreading the investment capital uniformly across a portfolio goes a long way in diversifying risk and avoiding overconcentration in few stocks. For example, the top 3% largest components in the STOXX USA 900 represent a third of the index’s total weight. By underweighting potentially crowded bets on single stocks and sectors, the portfolio can limit the effect of outsized individual share and industry moves, and lower overall volatility. Even if it means losing exposure to high-momentum parts of the market.

Another, related explanation suggests that an equal-weight portfolio benefits from underweighting stocks and sectors that may be overbought, if size can be interpreted as a proxy for popularity. Generally speaking, equal-weight portfolios allocate relatively more capital to stocks that have fallen out of favor with investors, and vice versa. This is the exact opposite to what market-cap-weighted indices do, and it creates a potential pattern of selling expensive stocks and buying oversold ones.

This trade is run systematically with the periodic rebalancing of indexed equal-weight portfolios, when a manager must pare back exposure to recent winners and increase those positions that have lost weight over the recent period. These adjustments create a buy low/sell high method that adds to returns in the long run, according to an analysis by Invesco.1 The asset-management company says that the vast majority of an equal-weighted portfolio’s outperformance can be attributed to disciplined quarterly rebalancing, with the remaining coming from a more consistent sector allocation.

The small-cap effect

A recent study by VanEck,2 however, is among those arguing that the outperformance of equal-weighted indices owes much to the strategies’ exposure to the size factor of small-cap stocks. In this study, the U.S. firm shows that the statistical distribution of individual stock returns is skewed. In particular, smaller shares tend to yield more extreme results – both on the negative and positive ends – than their larger counterparts, VanEck argues. Because the range and scope of positive returns more than offset those of negative returns, small-cap stocks are more accretive to the portfolio than large-cap stocks over time.

Academia has also in recent years identified fundamental risk factors as drivers of equal-weighted portfolios. A study published in the Financial Analyst Journal in 20113 found that most rules-based, non-market-cap-weighted allocation strategies outperform their market-cap-weighted counterparts because of exposure to the value and size factors.

Concentration risk in benchmark indices

The edge in equal-weight strategies may diminish in narrower indices where members’ weights diverge less.

Weight dispersion is significantly larger in a broad benchmark such as the STOXX Europe 600, where the top 5% of stocks account for almost 35% of the gauge’s weight, compared to approximately 12% in the case of the EURO STOXX® 50 Index, the Eurozone’s blue-chip benchmark. The smallest component in the STOXX Europe 600 currently accounts for 0.012% of the benchmark’s weight, while the smallest constituent of the EURO STOXX 50 represents 0.903%.

One metric to gauge constituency concentration risk is the so-called effective number of assets, which measures the breadth of holdings in a portfolio. For an equal-weighted index this number is the same as the number of components: the effective number of assets of the EURO STOXX 50 Equal Weight, for example, is 50. For market cap-weighted indices this number is typically lower than the number of components – i.e. for the EURO STOXX 50, it is around 40.

For the STOXX Europe 600, the effective number of assets grows to 600 from 152 when applying an equal-weight methodology. For the DAX®, it rises to 30 from 19. The significantly higher effective number of assets signals that equal-weight indices maximize diversification and minimize concentration risk on a component level.

Still, the EURO STOXX 50 Index gained 7.4% between the end of 1999 and Oct. 31 this year. That’s topped by the 43.9% advance from its equal-weight version.

Another tool in the passive-investments box

Equal-weight portfolios can provide a tool for investors seeking to capture a premium to the market’s move. Gianluca Oderda at Ersel Asset Management has argued that an optimal portfolio can be constructed by long positions in four non-market-cap-weighted schemes: a global minimum-variance portfolio, an equal-weight portfolio, a risk parity portfolio and a dividend-weighted portfolio; hedged via short positions in four respective market indices.4, 5

DAX, the iconic blue-chip index for German equities, this year turned 30. The index has expanded in value and in scope since 1988 and its family continues to grow, as shown by the launch of its equal-weight version.

Whether as a diversification tool or a smart-beta approach to extract the size and value factor premia, equal-weight strategies have gained many followers in recent years. And index providers have been responsive in making this approach available as one more alternative for passive investors seeking to outperform.

Featured indices

- DAX®

- DAX® Equal Weight Index

- STOXX® Europe 600 Index

- STOXX® Europe 600 Equal Weight Index

- STOXX® USA 900 Index

- STOXX® USA 900 Equal Weight Index

- EURO STOXX® 50 Index

- EURO STOXX® 50 Equal Weight Index

1 Invesco, ‘Equal Weight Investing.’

2 Van Eck, ‘Why Equal Weighting Outperforms: The Mathematical Explanation.’

3 Chow,T., Hsu, J., Kalesnik, V. and Little, B. M. (2011), “A survey of alternative equity index strategies”, Financial Analyst Journal, 67(5), pp. 37-57.

4 Oderda, G., ‘STOXX® Index-Based Risk-Controlled Portable Smart Beta Strategies,’ Ersel, January 2016.

5 Oderda bases the analysis on a stochastic portfolio theory (SPT) framework from E. Robert Fernholz.