The Sustainable Development Investments Asset Owner Platform (SDI AOP), which helps investors imbed the UN’s Sustainable Development Goals (SDGs) into investment processes, has been expanded to include analysis of companies’ negative contributions to the goals. The upgrade was released as part of the platform’s latest data update in August 2022 and was accompanied by rule refinements and additional functionality for subscribers.

The SDI AOP provides a groundbreaking tool to assess businesses’ revenue streams based on their contribution to the SDGs, and until now focused exclusively on positive impact. Introduced in 2020 by a consortium of asset owners APG, AustralianSuper, British Columbia Investment Management Corporation and PGGM, the SDI AOP is committed to accelerating the market adoption of Sustainable Development Investments (SDIs). Qontigo is the SDI AOP’s exclusive distribution partner.

James Leaton, Research Director at the SDI AOP, explained: “The original focus of the SDI AOP was on the opportunities related to SDGs based on positive contributions towards the goals. Following engagement with users, we have added data on products and services that are inconsistent with achieving the SDGs. This mirrors what we do on the positive side and gives greater differentiation across the universe of companies.”

The approach taken to determining negative SDG contributions follows the same methodology as the existing positive contributions. The SDI classification focuses on companies’ product and service-related contributions to the SDGs based predominantly on revenues. The SDI AOP does not net the positive and negative contributions, as “this would bury the complexity of considering impacts across different SDGs and diminish transparency around companies’ real-world impacts,” said Leaton.

Growth of impact investing

The SDI AOP is already helping guide and shape impact portfolios for some of the world’s largest investors. Dutch pension fund provider APG uses the iSTOXX® APG World Responsible Low-Carbon SDI Index for a mandate and Philips Pensioenfonds (PPF) has licensed the iSTOXX® PPF Responsible SDG Index as a key benchmark in the manager’s sustainable strategy. Both indices employ the SDI AOP classification and the mandates are managed by BlackRock.

Investors are increasingly adopting the SDGs as a holistic sustainability framework to understand investment outcomes. An SDG-lens analysis can identify companies’ absolute and relative contribution to improving social and environmental objectives, and can assist in constructing thematic portfolios and indices.

A snapshot of global companies’ impact

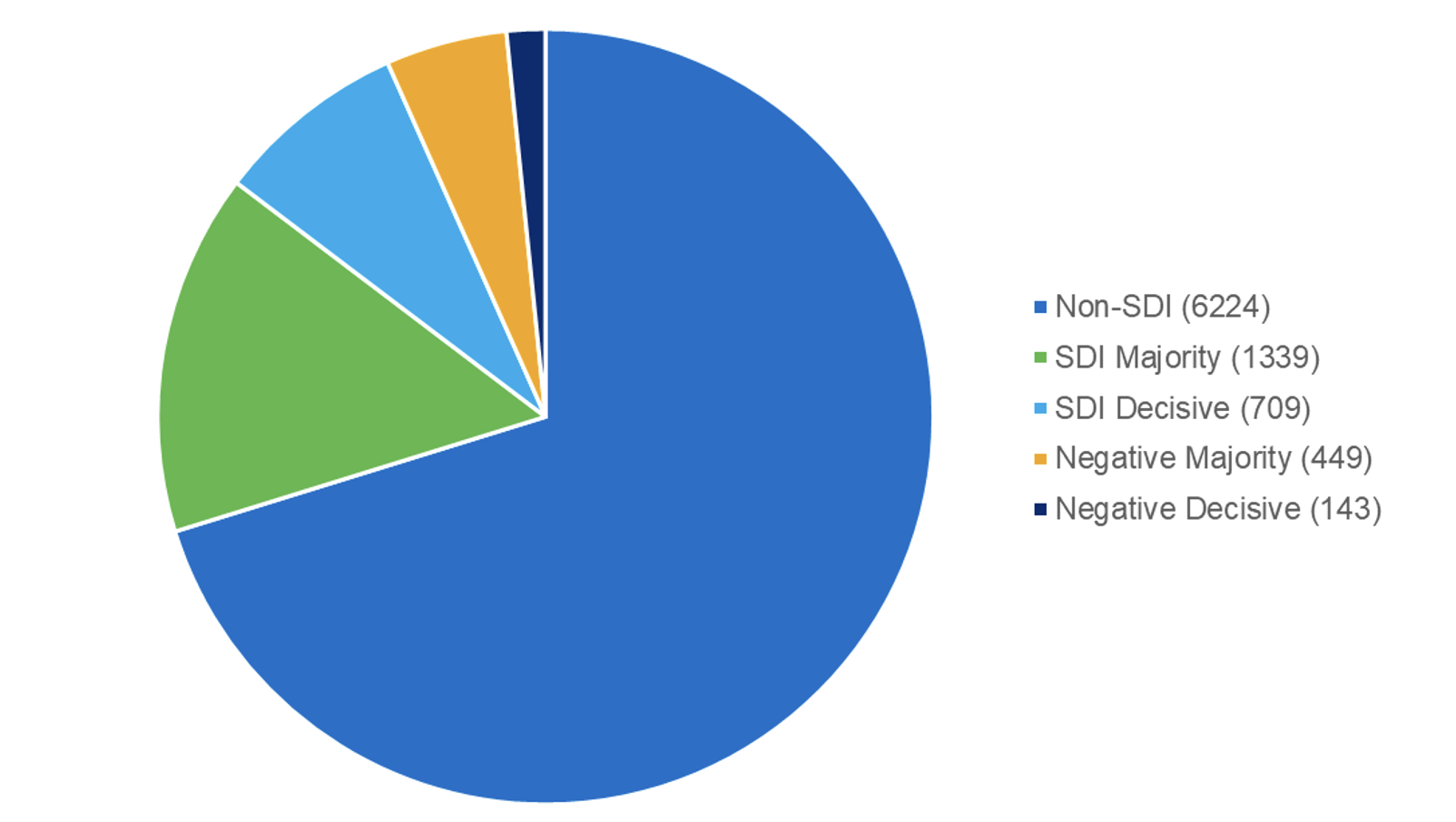

The platform’s data show that across a universe of nearly 9,000 entities, just under 600 have a material level (>10%) of negative products or services (Exhibit 1). Around 150 further companies have less than 10% of revenues generated by negative activities. By comparison, over 2,000 entities have been identified to have over 10% of revenues from SDG-aligned products and services.

The SDI classifies companies as having either a decisive (10-50%) or a majority (>50%) proportion of revenues impacting SDGs.

Exhibit 1 – Distribution of SDI and negative classification across the AOP universe

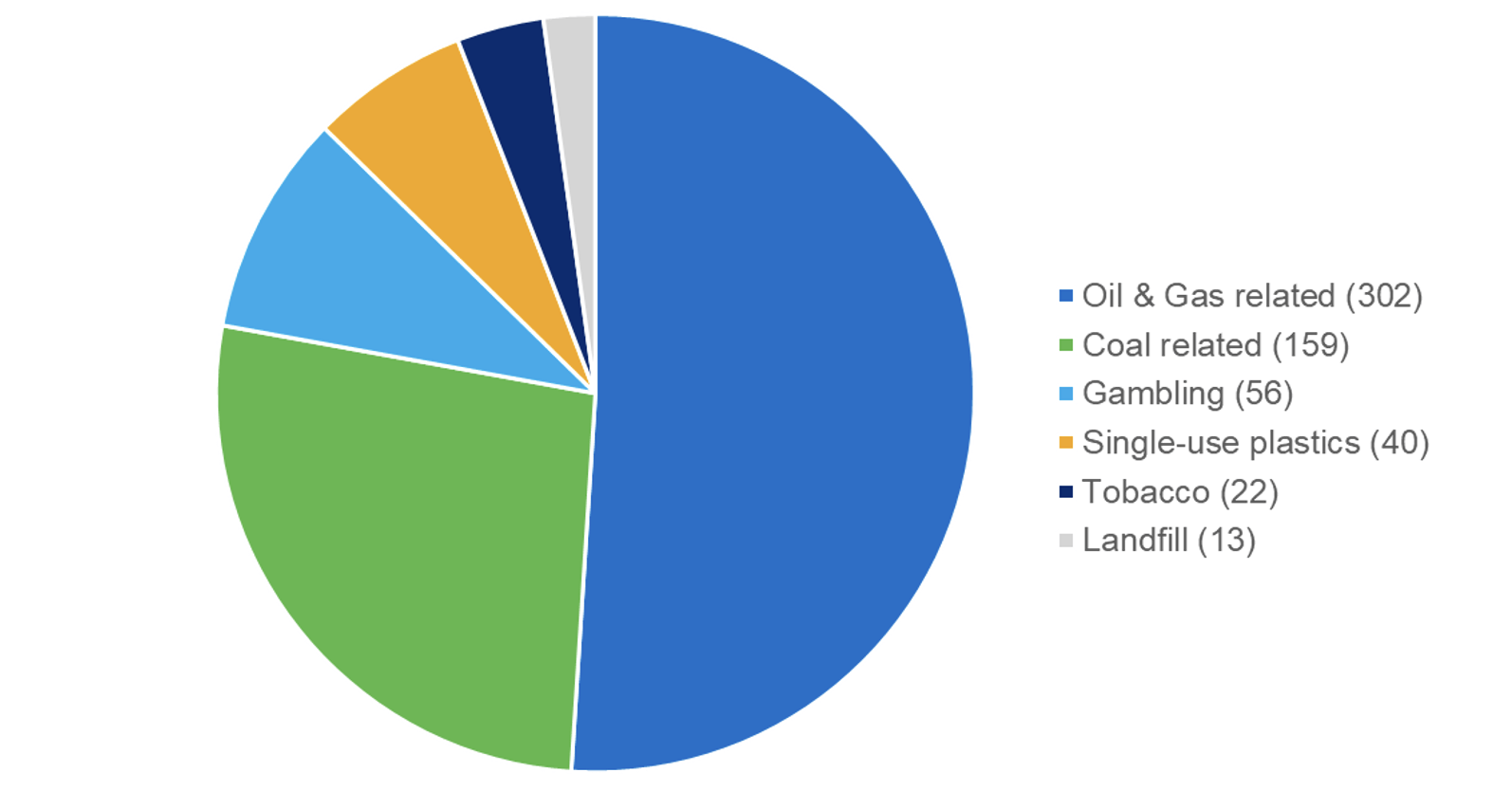

Within negative classifications, the most prevalent exposure is under SDG-7 (Affordable and Clean Energy), in relation to fossil-fuel products (Exhibit 2). Around a third of those are coal-related and two-thirds are in oil and gas. A similar number of entities are found to have material negative exposure to SDG-12 (Responsible Consumption and Production) because of producing single-use plastics or operating landfill, and to SDG-3 (Good Health and Well-Being) for tobacco or gambling products.

“Interestingly, there are relatively few cases — less than one hundred — where entities had a product mix containing both a material positive and negative contribution to the SDGs. This was most common amongst utilities, but also seen in packaging companies and other industrial firms,” said Leaton.

Exhibit 2 – Distribution of negative products and services classifications

More granularity

Another change in the platform’s August data release was the re-classification of activities around energy transition, including hybrid cars, energy storage and laminated packaging. A key area of focus here was the assessment of critical minerals suppliers that produce things such as lithium or rare earths, which are essential for manufacturing batteries and renewables. The review offers users even deeper granularity of products and services, leading to a more comprehensive analysis of the market.

The latest update will also make it easier to identify changes in revenues or classifications, as well as newly covered entities, all of which will be marked by special flags. Lastly, a new application that uses Qontigo’s Risk Entity Framework will help users more easily map fixed-income instruments in the analysis, an important development as more investors broaden an impact focus on bonds.

Starting in December 2022, the SDI AOP will increase the frequency of data releases to quarterly.

Next on the research agenda

The SDI AOP continues to evolve as it expands its coverage, incorporates newly available information and grows its user base. The team is working on adding more fixed-income coverage for high-yield and emerging markets, according to Leaton. Research partner Entis, which employs AI-technology to generate SDI classifications in the platform, is working alongside the asset owners to develop more forward-looking data points, such as patents and capital expenditures.

“This is looking really promising, with information around R&D activities having applications for identifying alpha potential,” concludes Leaton.