Digital technologies are taking charge of everyday activities, separating winners from losers in a fast-changing world.

It would be difficult to single out a more disruptive transformation in the last two decades, globally, than the penetration of the mobile phone and digital technologies in our daily lives.

The advancement of wireless connectivity and portable computers has surged since the mid-1990s, changing the way and patterns in which we do all sorts of tasks by means of a digital channel.

What exactly does digitalization mean?

Digitalization refers to the transformation of traditional and new activities via intelligent technologies. This transformation challenges and changes the way those activities are conceptualized and implemented. It forces us to deeply reconsider how we see the world, it alters business models, and reshapes consumers’ needs and the right solutions for them.

The digital world includes, among broad categories: e-business, e-commerce, social media, Internet search and interactive and transactional platforms. Some industries such as retail and banking are seeing profound migration to digital, although the transformation is not limited to them.

Rapid technology innovation is also coupling with customer education and expectations. Once the consumer becomes acquainted with a digital experience, they will seek to replicate it elsewhere, snubbing traditional or analog channels.

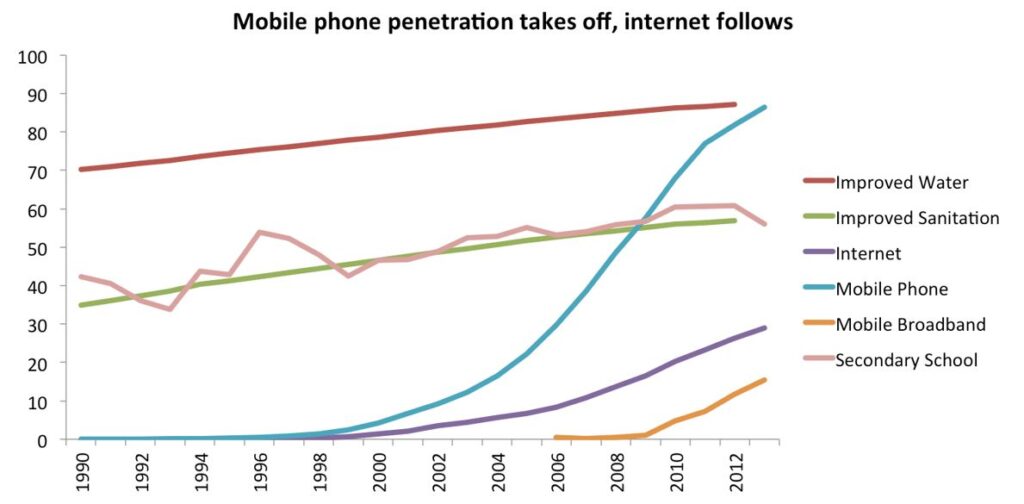

Chart 1 displays the trajectory of several development categories tracked by the World Bank through 2013.

Chart 1

More recent data shows digital access has continued to grow. Mobile-phone subscriptions now account for 108% of the global population, while 50% of the world’s inhabitants are now Internet users.1

With feeding trends such as ‘big data,’ artificial intelligence and the ‘internet of things’ all reaching new volumes and uses, digitalization is set to grow at a fast pace in coming years.

A shift of capital into new growth opportunities

The digital world is radically shifting economies and capital. It creates growth opportunities at the same time as it renders others obsolete. To try to capture the upside of this shift, digitalization became one of the themes covered by the STOXX® Thematic Indices, which track global, disruptive and modern megatrends defining our world today.

The Thematic indices represent a more precise vehicle to target a megatrend than, for example, doing it via a sector index. They are also a less costly approach than active fund management.

The STOXX® Global Digitalisation Index is derived from the STOXX® Global 1800 Index and its members are equally weighted.

The index is compiled via a rules-based methodology and best-in-class database from FactSet Revere, whose granular analysis selects companies that derive more than 50% of their revenue from business activities linked to the megatrend in question.

Payment-services providers in play

For the Digitalisation index, FactSet identifies companies active in 47 sectors. To name a few of those sectors: commercial bank software providers, streaming digital content sites, disk storage systems, network administration systems and express courier services.

Notably, the index contains several electronic payment services providers, a sector whose earnings growth potential has attracted a flurry of takeover bids this year from buyout firms including Blackstone and Permira. Paysafe Group Plc, Worldpay Group Plc, and Nets A/S have all become targets recently.

Many constituents in the index are niche and specialist technology providers. Better-known stocks include credit-card operators Visa Inc. and Mastercard Inc.; logistics companies United Parcel Service Inc. and Deutsche Post AG; as well as Internet giants Amazon.com Inc., Facebook Inc. and Alphabet Inc.

Accessing megatrends through listed and transparent passive products

Four STOXX Thematic Indices in 2016 became the underlying for respective exchange-traded funds (ETFs) managed by BlackRock’s iShares and listed in London, making index-based thematic investing more accessible to all.

More on investment megatrends

Featured indices

1 `2017 Digital Yearbook.’ Hootsuite and We Are Social.