Qontigo has announced the annual review results of the STOXX® Global ESG Leaders Index, the benchmark for sustainability champions. UK companies make up the highest number of entrants, at the expense of Japanese stocks.

A total of 81 companies entered the index on Sep. 20, including Aviva, Banco Santander and Williams Sonoma. British wealth manager St. James’s Place Plc has the biggest weight among entrants. Japan’s Tokyo Gas Co., JPMorgan Chase of the US and Sweden’s Ericsson are among 66 companies that have exited.

Following the review, the index comprises 410 constituents: 270 from Europe, 79 from North America and 61 from Asia/Pacific.

Best performers in each ESG category

The STOXX Global ESG Leaders Index is STOXX’s broadest benchmark tracking the highest-scoring companies in ESG criteria. The index is derived from three gauges covering each ESG category individually — STOXX® Global ESG Social Leaders Index, STOXX® Global ESG Environmental Leaders Index and STOXX® Global ESG Governance Leaders Index — with each one selecting companies that are leading in that category’s criteria and range above average in the other two. The composition of the three global specialized ESG indices was also reviewed.

The indices are compiled based on indicators from Sustainalytics, which researches companies employing internal data, media reports, and sector and public studies. Sustainalytics reviews a set of indicators for each of the three ESG categories, assigning a score ranging from 0 to 100 for each criterion. These scores are aggregated into a total company rating per ESG criterion using a weighted sum, where both indicators and weight are adjusted to reflect industry idiosyncrasies.

The ratings form the basis to calculate an overall ranking for each ESG category and finally for entry into the specialized ESG indices and the overarching STOXX Global ESG Leaders Index. The latter comprises all components eligible for at least one of the specialized indices and is weighted by the sustainability scores.

Before the selection process begins, companies deemed non-compliant with Sustainalytics’ Global Standards Screening (GSS) assessment,1 and those involved with controversial weapons, are excluded.2

For more on the methodology, please click here.

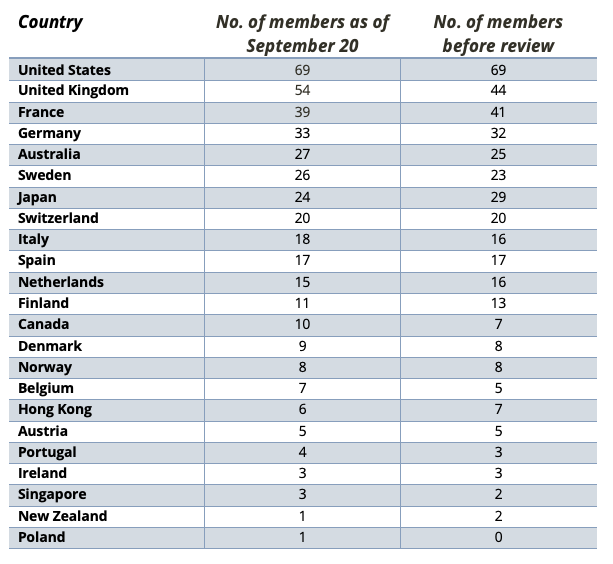

Table 1 – STOXX Global ESG Leaders Index members per country following latest review

While the US now accounts for a 14% weight of the Global ESG Leaders, it makes up 65% in the benchmark STOXX® Global 1800 Index.

1 GSS identifies companies that violate or are at risk of violating commonly accepted international norms and standards, enshrined in the United Nations Global Compact (UNGC) Principles, the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights (UNGPs), and their underlying conventions.

2 In case a constituent increases its ESG Controversy Rating to Category 5 and becomes non-compliant based on the Sustainalytics Global Standards Screening assessment, the respective constituent will be deleted from the index.